Budget 2020 : Fine Print Decoded

Indian Budget Aims at Providing Certainty and Relaxing Compliance for Non-Resident Taxpayers

The Union budget of India was announced on 1 February 2020. With the backdrop of the global slowdown, there was a lot of deliberations and expectations for introducing measures that may provide stimulus to the economy, means for meeting fiscal deficits among other concerns. Attracting foreign investors through simpler tax regimes also holds significant importance in providing the stimulus to the economy. Perhaps with this in mind, the Union Budget 2020, in more than one way, aims at providing enhanced certainty and relief from tedious compliances to non-resident taxpayers.

This article analyses certain key amendments introduced by the Union Budget 2020 which positively impact non-resident taxpayers under transfer pricing regime in India.

A. Permanent establishment (PE) of non-resident can now achieve tax certainty through APA and Safe Harbour mechanism with regard to profit attribution

Indian APA programme, introduced by the Finance Act 2012, has been regarded as one of the most successful programe providing certainty to taxpayers on tax front. The APA team have set a new benchmark for time taken to complete an APA proceedings; in some cases the Unilateral APA's were concluded within 12 months time. All of this has also resulted in record number of taxpayers approaching Indian revenue for achieving tax certainty through APA mechanism. Similarly, the safe harbour rules in India provide protection to small taxpayers from litigative transfer pricing environment in India with respect to covered transactions.

For non-residents doing business in India, PE is one of the most complex tax subject to deal with. Interestingly, the Indian tax regime does not define PE (except a very narrow definition given specifically under transfer pricing provisions). However, it seeks to tax PE situations through provisions contained in section 9 of the Income Tax Act, 1961 (“the Act”), which covers in its ambit income accrued or deemed to accrue to 'business connection in India'.

Globally the United Nations as well as the Organisation of Economic Co-operation and Development (OECD) also provide for attribution largely keeping in mind the PE's functional, asset and risk (FAR) profile.

Prevailing situation

a. Profit attribution as per the Indian Income Tax Rules, 1962 (“the Rules”)

Under the prevailing circumstances if it is established that there exists business connection aka a permanent establishment of a non-resident in India, the tax authorities determine profit attributable to such business connection by resorting to rule 10 of the Income Tax Rules (“the Rules”). The domestic tax law in India provide tax officers power to re-assess the income attribution but with limited guidance on the same. Tax officer have been assessing income attributable to a non-resident either as

- a percentage of the turnover accruing or arising in India, or

- a proportion of such receipts to the total receipts of such business, or

- in any other manner which the tax officer may deem fit.

This has resulted in various disputes between the taxpayers and the income-tax authorities over the years. The table below describes the approach (formulae) adopted by the Indian tax authorities for attribution of profits to PE:

Profit % at global level see note 1 below |

A |

28% |

Sales in India |

B |

100 |

Gross Profit on sales in India |

C=A*B |

28 |

% attributable to Sales functions of PE in India (adhoc) see note2 below |

35% |

|

Profit taxable in India |

9.80 |

Note 1: Typically, the tax authorities do not take actual global profit (which is assumed to be 28% in above example) stating that the data is not available, but assume it to be 10% in most cases as per the Rules.

Note 2: The % attributable to sales / marketing function of PE in India varies - 26% (GE Parts Inc.[1]), 35% (ZTE corporation[2]), 35% (Rolls Royce Plc[3]).

Interestingly, the CBDT recognising the inherent arbitrariness in the existing rules, formed a committee and came-out with a public consultation paper on rule for profit attribution to provide suggestions for changes in rule 10. The committee observed that business profits are contributed by both, demand and supply factors. Accordingly, the committee recommended a mixed approach which allocates profits partly to the jurisdiction where the consumers are located and party where the supply activities are undertaken. Basis the recommendations of the committee, the CBDT circulated draft Rule 10 which recommends a fractional apportionment approach that determines profit attribution based on a three factor method 1) Sales, 2) Manpower 3) Assets. Further in case of businesses in digitalised economy it recommends four factor approach where 4) Users can be considered as fourth factor.

With the above background it is fair to assume that the Indian tax authorities do not see FAR (Functions, Assets and Risk analysis) approach as a solution to determine profit attributable to PE.

b. Transfer Pricing analysis of PE

As discussed in previous paras, section 92F (part of transfer pricing chapter in the Act) includes the definition of permanent establishment. It may be inferred that Indian transfer pricing regulations suggests use of FAR approach to determine arm's length price even under PE situation.

At this stage it important to note the findings of Hon'ble Supreme Court case of Morgan Stanley & Co Inc. (292 ITR 416); on the issue of profit attribution to PE. In this case, the Supreme court opined -

“As regards attribution of further profits to the PE of MSCo where the transaction between the two are held to be at arm's length, we hold that the ruling is correct in principle provided that an associated enterprise (that also constitutes a PE) is remunerated on arm's length basis taking into account all the risk-taking functions of the multinational enterprise. In such a case nothing further would be left to attribute to the PE. The situation would be different if the transfer pricing analysis does not adequately reflect the functions performed and the risks assumed by the enterprise. In such a case, there would be need to attribute profits to the PE for those functions/risks that have not been considered.”

After the above ruling, many believed that the issue of profit attribution in the context of Indian subsidiary constituting PE has been put to rest. However, the committee provided an interesting interpretation to it and stated that further attribution (beyond remuneration of the subsidiary) to the PE is possible if it is found that PE is performing functions beyond the functions of subsidiary for which it has been remunerated. The committee relied on the Hon'ble Delhi ITAT decision in the case of Daikin Industries Ltd[4] drawing such conclusion.

Proposed amendment

The above possibility of additional attribution to PE (beyond transfer pricing analysis) might have also hindered the APA team to enter into an agreement for PE situations merely based on transfer pricing analysis.

With the proposed amendment by Union Budget 2020, as clarified under the Memorandum to Finance Bill that APA and Safe Harbour related provisions (which provide certainty) in the Act would now include in its ambit profit attribution to PE.

However, given the above controversy of additional profit (beyond transfer pricing analysis) and CBDT's proposal in draft Rule 10, it would be interesting to see whether the APA team would settle with FAR approach and transfer pricing analysis or it would insist on formulary approach to determine profit attribution in PE situation.

This is a timely and welcome move which is likely to provide much needed tax certainty to non-residents having permanent establishment that had to face litigation on attribution of profits in India. Considering the global uncertainties around profit attribution, this move should instil confidence in MNEs, having / proposing to have their operations in India.

B. Non-residents are now exempt from furnishing return of income in certain situations

Current provisions of section 115A of the Act provided relief to non-residents from filing of return of income in situations where only dividend or interest income are prevalent and TDS was deducted. However, the same relief had not been extended to non-residents whose total income consists of royalty or FTS income.

While acting on representations received in this matter, the budget sought to amend section 115A to provide relief to non-residents from filing their return of income in case their total income only consist of dividend income, or interest income, or royalty or FTS income and where the relevant TDS has been deducted.

The above is likely to provide significant relief to non-resident taxpayers from tax compliance burden.

On a related note, while the non-residents mentioned above may have got clarity on filing of return of income, however when such non-residents enter into transactions with associated enterprise (residents in India), they need to comply with the transfer pricing regulations under the present regime, viz 1) Furnish accountants report in Form 3CEB 2) prepare and maintain contemporaneous transfer pricing documentation. In the absence of any amendment in the union budget on this front, one can infer that non-resident taxpayers will have to still do such transfer pricing compliance, as applicable.

C. Non-resident taxpayer, other than foreign company, now also 'eligible assessee' for fast track DRP route; scope of covered issues also expanded

a. Non-resident, other than foreign company are also 'eligible assessee'

Taking cognisance of the delays that took place in tax litigation, the dispute resolution mechanism, inserted vide section 144C by the Finance Act, 2009, as a means to provide alternate mechanism to resolve tax disputes.

In the event an assessing officer proposes to make variations in the income or loss returned by a foreign company, the foreign company had the option to file objections to variations with the DRP. The DRP was mandated to issue directions within nine months.

Presently, the eligible assessee for the purpose of DRP route only includes 'foreign company' among the non-resident category. Accordingly, non-resident taxpayers who do not have legal status as company, for example, if the non-resident taxpayer is a partnership firm, then such taxpayers could not avail the benefit of above fast track dispute resolution mechanism.

Interestingly the Hon'ble Delhi HC had confirmed this position in the case of ESPN STAR SPORTS MAURITIUS SNC ET COMPAGNIE [TS-164-HC-2016(DEL)]. In the said case, both taxpayers (ESPN Star Sports as well as ESS Distribution) filed their respective returns of income with the status of a 'firm'. It was highlighted during the court proceedings that, Section 144C (15) (b) defines 'eligible assessee' as:

“(i) any person in whose case the variation referred to in sub-Section (1) arises as a consequence of the order of the Transfer Pricing Officer passed under sub-Section (3) of Section 92CA; and (ii) any foreign company.”

Accordingly, since none of the taxpayers are 'foreign company' but 'partnership firm', they are not eligible assessee for the purpose of DRP proceedings. The Hon'ble court opined as follows:

“It appears to the Court that it is plain that under Section 144C, the AO should have proceeded to pass an order under Section 143 (3) of the Act. Instead the AO confirmed the draft assessment order passed under Section 144C (1) of the Act. This, therefore, vitiated the entire exercise. The Court has no hesitation in holding that the final assessment order dated 28th January 2015 is without jurisdiction and null and void.”

While the above case provides relief to the taxpayers by holding that the Assessment order lack jurisdiction, however, principle that comes out of the above ruling is that non-resident (other than foreign company) are not eligible assessee under the prevailing situation.

Proposed amendment

The union budget 2020 proposes to expand the scope of 'eligible assessee' to now cover, any form of non-resident taxpayers in addition to the foreign company.

b. Scope of DRP relief beyond items under return of income

Similarly, the prevailing DRP regime has a restriction wherein only variation arising from the 'return of income' can be referred to the DRP for adjudication. In other words, if the taxpayers grievance (arising from the draft assessment order) is outside of 'variation from the income returned' the DRP would not have jurisdiction over such grievance under the prevailing regime. Similar situation arose in the case of Regen Renewable Energy Generation Global Limited [TS-36-ITAT-2020(CHNY)] , wherein -

During the assessment proceedings of a taxpayer (a non-resident), the AO referred the matter to the Transfer Pricing Officer (TPO) for determination of Arm's Length Price in respect of international transactions. However, the TPO found that no adjustment was required to the international transaction carried by the assessee. though AO accepted the returned income of the assessee, AO made an observation that the assessee is not eligible for the benefit of the India-Cyprus DTAA in relation to royalty and since such observation was prejudicial to the interests of the assessee, the AO passed a draft assessment order. The assessee raised an objection to such observation before the DRP. In this case the Hon'ble ITAT opined that, “Even though the assessee is an eligible assessee, there is no variation to the international transactions. Therefore, there cannot be any prejudice to the interests of the assessee…. passing of the draft assessment order itself is not warranted.”

Proposed amendment

As regards the issues that may be referred to the DRP the Union budget has made an amendment to now clarify that DRP will now have jurisdiction over any variation which is prejudicial to the interest of such assessee.

D. Exclusion of interest paid/payable to PE of a non-resident Bank for the purpose of interest limitation

Initially, section 94B was inserted in the Finance Act 2017, in line with Action Plan 4 of the OECD's BEPS programme, to provide a cap on the interest deductibility to tackle excessive debt financing. Accordingly, taxpayer's payment of interest to associated enterprises that exceeded INR 10 million were restricted to 30% of taxpayer's EBITDA. The excessive interest, beyond the said threshold could be carried forward up to 8 years.

Prevailing situation

Fundamentally, the 94B provisions cover borrowings in related party situation, however, it is interesting to note that the Indian transfer pricing regulation also contains deeming fiction, wherein, transactions with third party are also regarded as related party transactions if it meets certain conditions. One such condition being, quantum of loan borrowed from third party. For example, if the loan amount constitutes not less than fifty-one per cent of the book value of the total assets of the borrower, the lender (although third party) would be regarded as a related party in these situation.

Proposed amendment

In view of the above deeming fiction in certain situations, taxpayer borrowing from third party (PE of Non-residents), were not able to claim full deduction of the interest payment on such borrowings due to above referred interest limitation rules despite of bonafide intention. Further, since the profits of PE (lender) are taxable in India, loss to the tax authorities (base erosion) is less likely even if the borrower pays interests charges more than the normal.

The Union Budget 2020 seeks to remove such hardship on the taxpayers by specifically excluding interest payments to PE of Non-Residents engaged in the business of banking. It may be recalled, that earlier last year, government had significantly liberalised the borrowing conditions under exchange control regulations in order to meet the increasing capital fund requirements of Indian businesses. The said amendment removing interest limitation on the borrowings from banks fully complements such objective of infusing capital into the businesses. This amendment is effective from FY 2020-21.

[1] ITA No.671/Del/2011 / [TS-34-ITAT-2017(DEL)]

[2] 159 ITD 696 / [TS-5883-ITAT-2016(DELHI)-O]

[3] ITA No. 4078/Del/2013

Applicability of Transfer Pricing provisions to cases of Profit Attribution - Dust settled, Mystery solved!

Finance Bill 2020 has brought in amendments to the meaning of Significant Economic Presence (SEP) as also deferred applicability of the same by one year. Further, the scope of section 9(1)(i) has been widened by way of insertion of Explanation 3A. Thus, in the context of a non-resident, the meaning of “Business Connection” has been widened.

The current law provides for access to Rule 10 to the Tax Officer in order to determine income of a non-resident that is deemed to accrue or arise in India (including income attributable to operations carried out in India). However, attribution of profits to a Business Connection (Permanent Establishment under a DTAA) has always been a controversial issue with no clear guidance except for Rule 10. Various judicial pronouncements have held or suggested use of different parameters to arrive at the profits attributable to a Business Connection / Permanent Establishment, inter alia, placing reliance upon Rule 10 or the principles of Transfer Pricing (FAR Analysis), etc and thereby attributing a percentage of sales / profits to India operations of an MNC.

Considering that Rule 10 does not provide a solution for all types of situations and also considering the evolving ways of doing business, CBDT had rolled out Draft Rules for Attribution of Profits to a Permanent Establishment in 2019, however, the same have not been finalised as yet. It is anticipated that the said rules should be finalised before we enter the next financial year 2021-22. The Rules should definitely help solve a lot of issues around Profit Attribution.

Taking cognizance of the fact that a clarity and certainty around Profit Attribution would help settle a lot of dust, Budget 2020 has proposed amendments to the following sections prospectively:

1. Section 92CB relating to Safe Harbour Rules has been amended so as to bring within its purview, matters relating to Profit Attribution

2. Section 92CC relating to Advance Pricing Agreements (APA) has been amended so as to bring within its purview, matters relating to Profit Attribution

This would mean that in matters relating to Profit Attribution, a taxpayer can also have recourse to Safe Harbour Rules or APA provisions. It could be very interesting to note that an offshoot of the aforementioned amendments leads us to an answer to the following relevant and critical question:

a. Whether cases of Profit Attribution or determination of income of a non-resident on account of Business Connection is covered by Section 92 to 92F ('Transfer Pricing Provisions') of the Act?

Our Analysis

There have been cases in the past wherein in order to arrive at the Attributable Profits, recourse is taken, by taxpayers / tax authorities / appellate authorities, to FAR analysis over and above the route of access to Rule 10 which is an option available to the tax officer and provided for in the Law. In the context of separate entities / actual transactions, there have been judicial pronouncements wherein it has been held that once the transactions are considered to be at ALP, no further profits need to be attributed to a PE.

If the tax officer has any doubt about the amount / method of profit attribution, he can surely take recourse to Rule 10 (or the Profit Attribution Rules which are on the anvil or even the principles of Transfer Pricing, in desirable cases). We are not denying that the principles of Transfer Pricing may be of some help in the process. However, there is a very important difference here - While Transfer Pricing “principles” may be of some help in the exercise of Profit Attribution, Transfer Pricing Provisions do not cover Profit Attribution Cases.

One may possibly try to apply Transfer Pricing Provisions and compliances (Section 92 to 92F) to situations relating to Profit Attribution (for an instance, cases wherein tax officers may camouflage cases of Profit Attribution under the garb of a “Ghost” International Transaction between the Head Office and a PE and thereby referring the matter to TPO). This goes against the mandate of the Law.

Let us try to understand the scheme of the Act and DTAA in order to understand the difference between Profit Attribution and Transfer Pricing:

Profit Attribution - Provisions of the Act and DTAA

Under the Act

As per Section 9(1)(i) of the Act, all income accruing or arising, whether directly or indirectly, through or from any business connection in India shall be deemed to accrue or arise in India. Further as per clause (a) of Explanation 1 to section 9(1)(i), in case of a business of which all operations are not carried out in India, income as is reasonably attributable to operations carried out in India shall be deemed to accrue or arise in India.

While the Act does not provide for a specific mechanism to arrive at such a portion, one can and should draw reference and inference from the following:

(1) Audited financial statements of India operations as mandated by Companies Act

(2) Rule 10 of Income-tax Rules which provides for methods for arriving at the income as is reasonably attributable to the operations carried out in India in cases where the Assessing Officer is of the opinion that the taxable income cannot be definitely ascertained

(3) Report on Profit Attribution to Permanent Establishment rolled out by the Ministry of Finance on 18 April 2019 for public consultation wherein negating complete reliance on FAR analysis, focus of this report is on customer base / demand side / user base as a crucial parameter (FARM wherein M takes into consideration Market).

Under a DTAA

Generally, in case of a DTAA, Profit Attribution is governed by the provisions of Article 7 (Business Profits).

Article 7 normally provides that once it is established that the non-resident has a PE in the source country, Business Profits and other types of income attributable to such a PE are to be taxed under Article 7.

Different treaties may have different approaches for computing Profits under Article 7 viz. “Relevant Business Activity” Approach or a “Functionally Separate Entity” Approach. Further, OECD has also provided for an Authorised OECD Approach (AOA) which takes into consideration FAR analysis while determining Profits Attributable to PE based on “Functionally Separate Entity” Approach. India does not agree with the AOA.

While Indian Treaties provide for a Functionally Separate Entity Approach, they do not take into consideration adoption of FAR Analysis for arriving at the Attributable Profits. Under the Separate Entity Approach, a Head Office and a PE are considered hypothetically as being separate and independent entities and wherein the PE performs the same or similar functions as that of an independent enterprise under same or similar conditions.

Transfer Pricing - Provisions of the Act and DTAA

Under the Act

Transfer Pricing provisions are governed by section 92 to 92F of Chapter X of the Act read with Rules 10A to 10E. As per section 92, any income arising from an international transaction shall be computed having regard to the arm's length price (ALP). Section 92C, 92CA (and also 92CB and 92CC as existed before the amendments proposed by Finance Bill 2020) provide for provisions revolving around determination of ALP and do not cover any other situation.

Under a DTAA

Generally, principles of Transfer Pricing are enshrined in Article 9 of any DTAA which provide for applicability of Transfer Pricing principles in specific cases of transactions between an “enterprise of a contracting state” (defined to mean resident of one Contracting State) and “enterprise of another contracting state” (defined to mean resident of another Contracting State). Thus, the Transfer Pricing provisions engulfed in a DTAA apply only to transactions that are undertaken between enterprises, each of whom are residents of respective the Contracting States. Accordingly, Transfer Pricing provisions, as provided for in a DTAA should not apply to cases where both the enterprises (if there are) are non-residents, for example, transactions between HO and PE.

Whether, Transfer Pricing provisions as covered in DTAA override Transfer Pricing provisions under the Act is a matter which has not been settled as of now. Please also refer to Appendix 1 in this regard.

In a nutshell, inter play of regulations pertaining to Transfer Pricing and Profit Attribution is as under:

Sr. No. |

Parameter |

Income-tax Act, 1961 / Income-tax Rules 1962 |

Income-tax Rules, 1962 |

DTAA |

1 |

Determination of Profits / Income Attributable to PE / operations carried out in India |

Explanation 1 to Section 9(1)(i) |

Rule 10 Rules for Profit Attribution (currently in draft stage) |

Article 7 |

2 |

Determination of Arm's Length Price |

Section 92 to 92F |

Rules 10A to 10E |

Article 9 |

As can be seen from the above, Profit Attribution and Transfer Pricing operate in different spheres. This is also evident from the fact that specific and separate provisions have been provided both, under the Act as also a DTAA for each one of them.

While applying Article 7 that deals with Profit Attribution cases and provides for a Functionally Separate Entity Approach, one may take recourse to principles enunciated under Article 9 (Transfer Pricing). However, Article 9 does not provide for an automatic recourse to applying Article 7 that refers to a Functionally Separate Entity Approach. In the context of Article 7 vis-à-vis Article 9, we would also like to refer to Page 506 of the book “Klaus Vogel on Double Tax Conventions” (Fourth Edition) wherein Klaus Vogel has made the following observations:

At the outset, Articles 7 and 9 OECD and UN MC cover entirely different constellations. Article 7 OECD and UN MC deals with cases where only one 'person' (Article 3(1)(a) OECD and UN MC) is involved, whereas Article 9 OECD and UN MC assigns taxing rights within a group of two or more associated persons (companies).

This fortifies the argument that Transfer Pricing provisions (governed by Article 9 of a DTAA) cannot apply to situations of one person (cases of a PE of a non-resident and its Profit Attribution) which are actually governed by provisions of Article 7 (Business Profits). The above clearly evidences that provisions relating to Profit Attribution are different from provisions relating to Transfer Pricing while there may be certain principles of Transfer Pricing which may apply to specific cases of Profit Attribution.

Now, coming to the amendments proposed by Finance Bill 2020 and its relevance in this context, we would like to reproduce the proposed amendments:

Proposals by Finance Bill 2020

The following amendments have been proposed by Finance Bill 2020:

Safe Harbour Provisions

Sub-section (1) of section 92CB has been proposed to be amended and substituted with the following:-

(1) The determination of-

(a) Income referred to in clause (i) of sub-section (1) of section 9; or

(b) Arm's length price under section 92C or section 92CA,

shall be subject to safe harbour rules.

Advance Pricing Agreements

Sub-section (1) of section 92CC of the Income-tax Act has been proposed to be amended as follows:

“The Board, with the approval of the Central Government, may enter into an advance pricing agreement with any person, determining the-

(a) Arm's length price or specifying the manner in which the arm's length price is to be determined, in relation to an international transaction to be entered into by that person;

(b) Income referred to in clause (i) of sub-section (1) of section 9, or specifying the manner in which said income is to be determined, as is reasonably attributable to operations carried out in India by or on behalf of that person, being a non-resident”

Till date, as per the existing provisions, recourse to Safe Harbour Rules or APA was not available to a taxpayer for matters relating to Profit Attribution as the scope of these provisions was limited to matters relating to determination of ALP. Matters of Profit Attribution have now been categorically brought within the ambit of Safe harbour rules with effect from AY 2020-21and also within the ambit of APA for APA entered into on or after 01 April 2020. [It is interesting to note that even prior to the amendment, while the erstwhile law did not permit so, the Income Tax Department had, in its publication on APA Guidance with FAQs, had answered in its affirmative as regards applicability of APA to situations of Profit Attribution].

With the proposed amendments, going forward, non-residents will be able to take recourse to these two options (Safe Harbour and APA) in order to get certainty in matters relating to Profit Attribution in case they have a Business Connection / PE in India, which was hitherto restricted only to ALP cases.

It is worth noting that vide Finance Bill 2020, in both the sections 92CB and 92CC, the phrase “Income referred to in clause (i) of sub-section (1) of section 9” has been inserted as a separate and additional clause (in addition to the existing clause dealing with determination of arm's length price under section 92C and 92CA). It has not been merely added to the existing clauses of determination of arm's length price. Further, these amendments are neither clarificatory nor have they been inserted by way of Explanations. Provisions for both, Safe Harbour Rules as well as Advance Pricing Agreements, now categorically cover two different types of situations /cases:

a. Determination of Arm's Length Price; and

b. Determination of income attributable to operations carried out in India / profits attributable to PE

This makes it amply clear that the Law always intended to treat Profit Attribution and determination of ALP separately. A look at the relevant portion of the Memorandum explaining these provisions of Finance Bill 2020 also throws light on the intent:

“… Both SHR and the APA have been successful in reducing litigation in determination of ALP.

It has been represented that the attribution of profits to the PE of a non-resident under clause (i) of sub-section (1) of section 9 of the Act in accordance with rule 10 of the Rules also results in avoidable disputes in a number of cases. In order to provide certainty, the attribution of income in case of a non-resident person to the PE is also required to be clearly covered under the provisions of the SHR and APA.

In view of the above, it is proposed to amend section 92CB and section 92CC of the Act to cover determination of attribution to PE within the scope of SHR and APA”.

The above makes it further clear that as a principle, matters relating to Profit Attribution do not get governed by the provisions of section 92C / 92CA that deal with determination of Arm's Length Price, but are governed by section 9(1)(i) read with Rule 10.

The fact that Profit Attribution and Transfer Pricing are different also finds weight in the following observations made by the Committee in its Report on Profit Attribution:

Sr. No. |

Reference |

Observation summarised |

1 |

Covering Page (of the Report) by Ministry of Finance - Para 2 And Para 5 of the Report |

Under Article 7 in the Indian treaties, profits are to be attributed to the PE as if it were a distinct and separate entity on the basis of the accounts of the PE and where such accounts are not available to enable determination of profits attributable to the PE, the profits attributable to the PE can be determined under the domestic laws. For application of this method, the Assessing Officer in India can resort to Rule 10 of Income-tax Rules |

2 |

Footnote No. 30 on Page 22 of the Report |

The transfer pricing aims to determine the arm's length price, which is different from profits derived by application of arm's length principle between two entities. |

3 |

Para 48 |

FAR Analysis cannot be used for Profit Attribution |

4 |

Para 103.3 |

FAR Analysis applied for determination of ALP can appropriate for Transfer Pricing, however the same does not hold true for Profit Attribution |

It would not be out of place to refer to the amendment brought in by Finance Act 2012 relating to Specified Domestic Transactions pursuant to the decision of Supreme Court in the case of CIT v. Glaxo Smithkline Asia (P) Ltd. [(2010) [TS-5035-SC-2010-O]]. In the said decision, the Supreme Court very categorically mentioned that while the principles of Transfer Pricing would be useful in cases of Domestic Transactions between related parties, the law needed to be amended so as to provide for requirements of maintenance of TP Documentation and Chartered Accountant's Report (Form 3CEB) in such cases. Post this, suitable amendments were made in order to apply Transfer Pricing provisions to domestic transactions. Drawing an inference and particularly considering that Finance Bill 2020 has proposed amendments only to specific sections, 92CB and 92CC, it is very important to understand that the Transfer Pricing provisions as they currently apply, do not cover situations of Profit Attribution. Also, considering that specific Rules for Profit Attribution are expected to be introduced in the near future, we do not see a possibility that the Government would make amendments to Transfer Pricing provisions so as to cover Profit Attribution cases, even in the future.

The proposed amendments are a welcome step as going forward, taxpayers will have the following references / options to arrive at the Profits Attributable to PE:

a. Audited financial statements;

b. Rule 10 of the Rules;

c. Safe Harbour Rules (as a result of the amendment proposed in Finance Bill 2020);

d. Advance Pricing Agreements (as a result of the amendment proposed in Finance Bill 2020);

e. Rules on Profit Attribution (currently in draft stage)

More importantly, there are quite a few cases pending at various levels on the matters relating to Profit Attribution, wherein Tax Officers have taken recourse to Transfer Pricing Provisions (section 92 to 92F) to force upon Transfer Pricing compliances / assessment on the taxpayers in order to actually arrive at the profits attributable to PE. The amendments provide a clear indication that matters pertaining to Profit Attribution are separate and are not governed by Transfer Pricing provisions. These would help strengthen the taxpayer's position and act as a final nail in the coffin, in cases which were subjected to Transfer Pricing Provisions and compliances under the garb of existence of an international transaction.

One can only hope that the final Profit Attribution Rules do not create any storm and let the dust remain settled!

Appendix 1

As regards Treaty Override in case of Transfer Pricing provisions, we would like to highlight a very interesting observation by Ahmedabad Bench of ITAT in the case of Shell Global Solutions International BV [2016] [TS-6578-ITAT-2016(AHMEDABAD)-O]

“On the first principles, therefore, the transfer pricing legislation cannot be rendered ineffective on the basis of the limitations in the provisions of Article 9. This principle is statutorily recognized in tax legislation in many jurisdictions, including in the fatherland of Dr Vogel himself- on whose commentary so much reliance has been placed by the learned counsel. Of course, a clear indication to that effect in Section 90 would certainly have helped clarifying this position and, to that extent, any anti abuse legislation, even if integral part of the Income Tax Act, must always, if so intended, clearly and unambiguously qualify the treaty superiority over the domestic law. That, however, does not seem to be the case. Section 90(2) does give a somewhat unqualified superiority to the treaty provisions over the provisions of the Income Tax Act which contain transfer pricing legislation as well. If an anti abuse law, whether a specific anti abuse regulation (SAAR) or a general anti abuse regulation (GAAR), is to apply only to a non treaty situation and does not extend to a treaty situation, it will infringe neutrality. That cannot have any sound conceptual justification and would be in gross deviation with the best practices globally. It is high time that the stand of the tax administration on this issue is clearly reflected in the legislation, and this kind of a litigation, as before us in these appeals, is avoided.

While the Bench has not ruled on whether Article 9 overrides Indian Transfer Pricing provisions, the above observation is worth considering wherein the Members have suggested that the tax legislation should incorporate superiority of Anti-Avoidance provisions over Treaty provisions. However, currently, section 90(2A) provides for Treaty Override only in case of GAAR provisions (Chapter X-A) and not Chapter X (which include Transfer Pricing provisions) and hence, their remains a strong case to argue that Article 9 of a DTAA should override provisions of section 92 because of the unqualified superiority being accorded to DTAA pursuant to section 90(2).

[This article is co-authored by Dhaval Trivedi (Director , International Tax, K C Mehta & Co)]

Budget 2020: Proposed TCS Provisions - Widening the Tax Net or Tax Compliance Burden?!

Provisions pertaining to collection of tax at source ('TCS') were introduced in the Income Tax Act, 1961 ('the Act') w.e.f. April 1, 1988 in respect of sale of certain goods such as scrap, tendu leaves, alcoholic liquor, timber etc. As per the framework, seller of such goods is required, at the time of sale, to collect an additional amount over and above the sale consideration, a 'presumptive tax' from the buyer of such goods.

The rationale for such levy, as explained in the Memorandum to the Finance Bill, 1988, was that the Government wanted to get rid of the hassle of assessing income and recovering tax due on the income of persons dealing in such goods as the past experience revealed that such persons did not maintain proper accounts and that their business activities lasted for a short span of time post which they would not be traceable. Many of them were found to be dealing in benami names or would not file an Income tax Return ('ITR'). Hence, there was tax evasion on a large scale. This rationale was also reiterated by the Hon'ble Supreme Court ('SC') in UOI v. A Sanyasi Rao & Others (1996 AIR 1219) while upholding the validity of TCS provisions, when being challenged by the assessees.

Since 1988, these provisions saw some amendments adding new products or services under the TCS net, where recently the Government covered high value transaction of purchase of motor vehicle of value exceeding Rs. 10 lakhs under the ambit of TCS.

Now, vide the Finance Bill 2020 ('FB 2020'), the Government proposes to collect TCS broadly in respect of two transactions, namely, overseas remittances and purchase of goods worth more than Rs. 50 lakhs from one person during the year. The Memorandum to the FB 2020 states that the intent of expanding the scope of TCS provisions is to widen and deepen the tax net.

TCS is not an additional income tax but is akin to any other tax deduction at source ('TDS'). The credit of TCS shall be allowed to the remitter of foreign exchange/buyer against the tax liability in respect of his taxable income, if any. Else, refund of TCS needs to be claimed by filing an ITR.

A fundamental question arises as to whether the rationale with which the TCS provisions were introduced in 1988 still holds good given that the Government now has other machinery provisions in the Act that could be optimized to create a transaction trail and check tax evasion?

Let us examine the TCS related amendments proposed in the FB 2020.

Levy of TCS on transactions covered under the Liberalised Remittance Scheme ('LRS') and overseas tour program package:

“Section 206C(1G)- Every person,

(a) being an authorised dealer, who receives an amount, or an aggregate of amounts, of seven lakh rupees or more in a financial year for remittance out of India from a buyer, being a person remitting such amount out of India under the Liberalised Remittance Scheme of the Reserve Bank of India;

(b) being a seller of an overseas tour program package, who receives any amount from a buyer, being the person who purchases such package,

shall, at the time of debiting the amount payable by the buyer or at the time of receipt of such amount from the said buyer, by any mode, whichever is earlier, collect from the buyer, a sum equal to five per cent of such amount as income-tax”

Clause (a) is applicable to an authorised dealer ('AD') receiving an amount or amounts aggregating more than Rs. 7 lakhs in any financial year ('FY') from one person for remittance out of India under the LRS and casts an obligation on the AD to collect tax @5% (10% if no PAN/Aadhar) on the entire amount of remittance.

The LRS permits the resident individuals, as defined under the Foreign Exchange Management Act, 1999, to remit upto $2.5 lakhs per FY for specified current and/or capital account transactions thereby allowing free flow of funds outside India.

Specified current account transactions include private visits to any country (except Nepal and Bhutan), gift or donation, going abroad for employment, emigration, maintenance of close relatives abroad, travel for business, meeting medical expenses, studying abroad etc.

Specified capital account transactions include opening of foreign currency account abroad with a bank, purchase of property abroad, making investments abroad, setting up wholly owned subsidiaries and joint ventures abroad, extending loans including loans in Indian Rupees to Non-resident Indians who are relatives as defined in the Companies Act, 2013 etc.

Post the increase in the limit of LRS in 2015 from $1.25 lakhs to $2.5 lakhs, there has been a sudden upsurge in the quantum of flow of money outside India from $1 billion in FY 2011-2012 to over $13 billion in FY 2018-2019[1]. Also, highest ever monthly remittance abroad of $1.87 billion was recorded in August 2019[2]. As per the RBI data, the composition of this sudden rise in 2019 highlights that 'travel' constitutes most of the spending outside India ($4.8 billion) followed by 'education abroad' ($3.5 billion), 'maintenance of close relatives abroad' ($2.8 billion), 'gifts' ($1.3 billion) and 'investment in immovable property and shares abroad' ($0.5 billion), being the lowest.

As per the report by Spark Capital published in 2018[3], it was alarming that this jump in foreign travel expense does not commensurate with the fact that there has not been a similar spike in the number of outbound travellers from India. A report by SIT[4] reveals that remittances under the LRS are used for tax evasion[5]. There have been concerns that some Indians in the US are probably using the LRS to dodge US tax authorities.

This alarming flight of funds outside India has been under the critical scanner of the Indian tax authorities for the past few months now. In the wake of the same, around 30,000 individuals who remitted money abroad under the LRS were issued income tax scrutiny notices during 2019 basis the information of foreign assets and expenses disclosed in the ITRs filed by them[6].

Thus, the roadmap to this amendment proposed in FB 2020 seems to be a conscious attempt by the Government to track and investigate the genuineness and bonafides of remittances done using the LRS limits. The intention seems to be to collect complete data of all remittances which otherwise are freely transferable under the LRS.

Clause (b) of Section 206C(1G) pertains to TCS on foreign tour packages purchased. The TCS compliance shall be on the seller selling such packages wherein he shall collect additional tax @5% (10% if no PAN/Aadhar) from the buyers.

There is no monetary threshold prescribed and hence, the seller shall collect tax on the entire amount of foreign tour package, irrespective of its value.

Levy of TCS on sale of goods:

“Section 206C(1H)- Every person, being a seller, who receives any amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, other than the goods covered in sub-section (1) or sub-section (1F) or sub-section (1G) shall, at the time of receipt of such amount, collect from the buyer, a sum equal to 0.1 per cent of the sale consideration exceeding fifty lakh rupees as income-tax”

Thus, the seller, whose turnover exceeds Rs. 10 crores in the prior FY is obligated to collect tax at source @0.1% (1% in case of no PAN/Aadhar) of the sale consideration exceeding Rs. 50 lakhs during the year from a buyer. Thus, if the total sales to the buyer during the year is say, Rs. 52 lakhs, TCS will apply only on Rs. 2 lakhs @0.1%.

Note that the obligation to collect tax at source is cast on the 'seller' of overseas tour packages or goods and hence a strict technical reading suggests that even a non-resident seller selling to customers in India would be covered and required to undertake all the compliances pertaining to TCS, namely, obtaining Tax Deduction Account Number, payment of taxes collected, quarterly filing of TCS returns, issuing tax collection certificates etc.

TCS provisions are compliance provisions wherein the tax liability of a person is cast upon another person as a mechanism for ease of tax collection. However, it may not be proper to extend this compliance burden of tax liability of persons resident in India on non-residents. Reference is drawn to the observation made by the Hon'ble SC in the case of Vodafone International Holdings B.V v. UOI (S.L.P. (C) No. 26529 of 2010) wherein the SC remarked that a procedural section like section 195 would not have extra territorial application in case of non-residents. It is imperative that the Government brings an amendment to exclude non-resident sellers from the ambit of TCS provisions.

Similarly, concerns are raised that the Indian exporters of goods are also required to comply with TCS provisions. As the overseas buyers are not likely to have a PAN/Aadhar, the TCS shall be at 1%. While the Government has clarified that this is not the intent, necessary exclusion should be brought in the Act itself.

The Memorandum to FB 2020, does not explicitly provide the rationale for casting TCS burden on such high value transactions of sales above Rs. 50 lakhs as also foreign remittances above Rs. 7 lakhs under the LRS as it is quite likely that these buyers are not benami, nor are they likely to be in the income tax bracket not requiring them to file an ITR or pay appropriate taxes. More likely than not, the remittance under the LRS would have happened out of the post-tax paid income or savings.

Over the past few years, the Government, in its efforts to gather data pertaining to foreign remittances, has already made various amendments under the Act. These include incorporating a separate schedule for disclosure of 'foreign assets' in the ITR, mandatory filing of ITR by individuals spending more than Rs. 2 lakhs on foreign travel during the year even if their total income may be below the minimum taxable threshold. Further, there is a mandatory annual reporting of Specified Financial Transactions ('SFT') in Form 61A by ADs for receipts exceeding Rs. 10 lakhs from a person for sale of foreign currency, including credit of such currency to foreign exchange card, issue of travellers' cheques in excess of Rs. 10 lakhs, and issue of debit cards loaded in foreign currency. SFT reporting is also required by other agencies for investments made by the buyers in immovable property or other assets above a particular threshold.

Thus, there seems to be already a sufficient mechanism in place for the Government to gather information pertaining to foreign currency transactions and foreign travel by residents as also tracking transactions of sales and purchases of goods. The Government could have further expanded the scope of the existing SFT provisions to include reporting of transactions under the proposed TCS provisions.

Levy of TCS would only add to the administrative and compliance burden of the ADs/the sellers, the buyers/taxpayers as well as the tax authorities.

As regards the TCS on LRS for studies abroad, typically, the students take loans or use their savings and may not have a taxable income/tax filing obligation in India once they go abroad for higher studies. They would now have to file an ITR in India to claim a refund of TCS.

Likewise, where a senior executive earning salary income remits money to pay for higher education of his child abroad, he may have to claim a refund for TCS in his ITR since his earnings are otherwise subject to TDS. This will lead to blockage of funds. Hence, necessary amendments should be made in the TDS provisions enabling the employer to grant credit for TCS while deducting tax on the salary income.

The Government can also consider excluding remittance for education and medical expenses abroad from the purview of TCS as this would otherwise cause unnecessary hardship to the remitters.

The ADs/sellers would need to set up dedicated processes and resources to ensure TCS compliances. On the other hand, the number of applications for refunds filed by the taxpayers may also increase manifold, which in turn, would put stress on the tax authorities to process such refunds.

An option of using other machinery already available under the Act for gathering more information from the taxpayers, and thereafter, focussing only on suspicious cases could have been a more fruitful approach which the Government could have considered, rather than expanding the scope of TCS.

An example worth quoting is the insertion of sub-section (1D) to section 206C of the Act vide Finance Act, 2016 for levy of TCS on purchase of jewellery, bullion and any other goods in cash above Rs. 2 lakhs and subsequent deletion of the same vide Finance Act, 2017. With the introduction of section 269ST prohibiting receipt of cash of more than Rs. 2 lakhs during a day or pertaining to a single transaction, the need for TCS on such transactions was not felt necessary and hence the TCS on such cash transactions was done away with.

Further, as a crack down on cash transactions and promoting use of digital modes of payment, a plethora of amendments have been introduced in the Act over the past years, such as, TDS on cash withdrawals, restriction on cash transactions above Rs. 2 lakhs, disallowance of certain tax deductions if payments are made in cash, prohibition on acceptance of cash loans/deposits, prohibition on repayment of loans/deposits in cash, mandating new modes of electronic payments (like BHIM UPI, Rupay cards) to be put in place by persons having turnover of more than Rs. 50 crores, etc.

Thus, the Government is using every possible means to ensure that transactions do not go unreported and escape the tax net. Can the Government, therefore, consider rollback of TCS provisions?

(This article is co-authored by Pooja Agrawal, Manager-Taxation, Piramal Enterprises Limited.)

[1] RBI bulletins issued available at following links: (2012): https://m.rbi.org.in/scripts/BS_ViewBulletin.aspx?Id=13895; (2019) : https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/35T_11072019298403DE4F794909A2571D2CB534FF7A.PDF

[2] RBI bulletin: https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/35T_111120192FDC7640C0084C8CAABB6F9B1855745C.PDF

[3] Source: Article by The Wire Analysis dated 16 September 2019

[4] Special Investigation Team constituted under the Black Money Law.

[5] As per the news article of Economic Times dated 27 August 2019

[6] As per the news article by Business Standard dated 23 October 2019 titled “I-T dept scans 30,000 individuals for remitting money abroad via RBI scheme”

Changing Landscape for Tax Management: 'New Tax Scheme' for Individuals having Business Income

1. In our previous article on the new tax scheme (Section 115BAC), we discussed the personal tax perspective and underlying questions. Here we discuss the case of individuals with business income who could opt for the new scheme.

2. The Finance Minister in her Finance Bill 2020 proposed new and simplified tax scheme wherein individual taxpayers having business income will need to forgo certain deduction and exemptions. In light of the deductions / exemptions not allowable under the new tax scheme, the key factors to be considered while deciding to opt for the scheme are:

2.1. The loss accumulated on account of deductions specified in the new scheme and period for which a taxpayer is eligible to carry forward & set-off;

2.2. The house property loss accumulated and available for carry forward and set-off;

2.3. Quantum of Alternate Minimum Tax (AMT) credit available for utilisation;

2.4. Deductions being availed on account of expenses / investments under chapter VIA.

3. Considering the tax rates under the new scheme, here is a comparison of tax rate applicable to various forms of business. The income tax statistics for AY 2018-19 indicates that less than 1% of the combined Individual and family run business fall into the highest surcharge rate of 37%. The businesses in proprietary / family run models enjoy tax free profit extraction wherein profit distribution of corporates suffer a dividend tax in the hands of the shareholder. Considering these differentiating factors, for businesses which intend to plough back profits for growth, the corporate structure seems like a lucrative option. For small and medium enterprise businesses with high profitability, the Firm / LLP option offers tax efficiency.

|

Section |

115BA |

115BAA |

115BAB |

115BAC |

Firms / LLP First Schedule of Finance Act |

Other Corporates First Schedule of Finance Act |

Foreign Company First Schedule of Finance Act |

Applicable to |

Domestic Manufacturing Companies (Optional) |

All Domestic Companies (Optional) |

New Domestic Manufacturing Companies incorporated after 01.10.2019 and commenced production on or before 31.03.2023 (Optional) |

Individuals / HUFs having business income (Optional) |

Partnership Firms / LLPs |

Other Corporates not opting for any other scheme |

Foreign Company |

Effective tax rates at the highest surcharge rates |

29.12% @12% surcharge |

25.17% @10% surcharge |

17.16% @10% surcharge |

42.74% @37% surcharge |

34.94% @12% Surcharge |

34.94% @12% Surcharge |

43.68% @5% surcharge |

Analysing some of the questions in the context:

4. Who can opt for the new tax scheme and what are the underlying conditions?

The new tax scheme is effective for any previous year relevant to the assessment year beginning on or after 01.04.2021 i.e. taxpayer can switch to the new regime from the Assessment Year 2021-22 onwards.

The option should be exercised any time before the due date of filing the return of income. Once opted to be governed by the new scheme, a taxpayer having business income will not be allowed to opt out of the scheme. However, switching to old scheme is available only once during the lifetime unless the taxpayer ceases to have business income.

In case of failure to comply with the conditions laid down in the section for any assessment year, the option will become invalid for that assessment year and will be governed by the existing scheme for subsequent years.

5. Is the new scheme available to taxpayer having profession income as well?

The income tax act, under the head Profits and Gains from Business / Profession, has envisaged 2 types of taxpayers viz., taxpayer having business income and taxpayer having profession income. The act in various forms have distinguished businesses from profession. In the context of opting in/out of the new tax scheme, the taxpayers having 'business income' finds a specific mention on applicability. Hence, it appears the legislature intends to allow the Individuals having profession income the choice to opt in / out of the scheme every year. A specific clarification from the legislature in this regard would augur well.

6. Can a taxpayer carry forward AMT credit after opting for the new tax scheme?

A taxpayer opting for new tax scheme is not liable to pay AMT. AMT credit accumulated, if any will lapse once opted to be governed by the new scheme in the year of exercising the option.

7. Will the brought forward losses lapse if you opt for the new scheme?

The taxpayer should note that the new scheme has brought in restrictions on carry forward and set-off of losses. In certain situations, the brought forward losses will lapse. More importantly the taxpayers should note that the overall times limit available for the losses to be carried forward and set-off remains the same.

There is no change in the set-off and carry forward of losses under the head capital gains and income from other sources. Below is a summary of the losses being impacted on the brought forward, current year loss and carry forward loss under the new tax scheme.

|

SL No |

Particulars |

House Property Loss |

Business loss |

Unabsorbed Depreciation |

1 |

Brought Forward |

The loss is eligible to be carried forwarded and set-off other than the loss from self-occupied property. Refer note 1 |

If the loss is attributable to any deductions referred above in Para 6 the loss cannot be carried forward and will be deemed to have been given full effect. Any other business loss is eligible to be carried forward and set-off. |

Unabsorbed depreciation will be adjusted with the WDV. CBDT is yet to notify the mechanism for adjustment. Refer note 2 |

2 |

Current Year loss |

Deduction for interest on self-occupied property not allowed. Intra-head loss adjustment is allowed but no set-off against any other head of income. Unutilised loss is deemed to have been given full effect in the same year. |

Eligible to be set-off and carried forward subject to the deductions not allowed under the new scheme. |

No claim of additional depreciation allowed. Unabsorbed depreciation on account of normal depreciation allowed to be set-off and carry forward |

3 |

Carry forward of loss |

No carry forward allowed. Refer note 1 |

Subject to Row 1 & 2, Carry forward allowed |

Subject to Row 1 & 2, Carry forward allowed |

Note1: The brought forward loss other than loss attributable to self-occupied property can be set-off against the head income from house property. Further, a taxpayer may choose to carry forward the earlier year losses to be set-off in a year not governed by the new tax scheme. The new scheme does not bar a taxpayer in carry forward of such loss.

Note2: The depreciation adjustment will be positive adjustment to the WDV. The adjustment will be undertaken on the first day of the previous year for which a taxpayer opts to be governed by the new scheme.

8. Can a taxpayer opt to be governed by the new tax scheme if he has also opted for presumptive income tax?

It is imperative to note that the new tax scheme is only a mechanism to determine the income tax payable by a taxpayer subject to conditions therein. It is only after determination of the total income, the provisions of the new scheme will kick in.

On the other hand, take for ex. 44AD and 44ADA, presumptive income scheme for business and professionals. There is nothing conflicting in the above sections and the new tax scheme except for the condition that the deductions from section 30 to 38 are deemed to have been given full effect; wherein new tax scheme has restricted some of these deductions available under these sections.

The presumptive tax scheme gives rise to 2 situations:

a) A taxpayer maintains no books of accounts and offers income as per the prescribed percentage of turnover or gross receipts

b) A taxpayer claims to have earned lower income compared to the prescribed percentage of turnover or gross receipts. In result, the taxpayer would maintain books of accounts and gets his books of accounts audited in order to justify the lower income.

In situation (a) above, the deductions under the section 30 to 38 is a deeming fiction and the taxpayer may have incurred those deductions or not. The presumptive tax scheme is designed to provide relief to small businesses and professionals. The tax rate under the new scheme should be available. To strengthen the case, an argument could be made to say unless a specific deduction which is restricted under new scheme is claimed, opting for the new tax scheme should be held valid. However, the tax office may dispute the application of new tax scheme in the context of the violation of conditions related to deductions. It is for the government to clarify this aspect.

In situation (b) above, the books of accounts are maintained and audited. Identification of the deductions would not be a challenge in application of the existing or new tax scheme.

9. As a matter of reference, we have provided below a comparison of the deductions / exemptions not available under the 4 special tax schemes currently available under the Income Tax Act

|

Exemptions / Deductions not to be considered |

115BAC |

Section 115BA |

Section 115BAA |

Section 115BAB |

Applicable to |

Individual / HUF having Business Income |

Domestic Manufacturing Companies |

Any Domestic Company |

New Domestic Manufacturing Company |

Section 10AA - Exemption for SEZ unit |

Not Available |

Not Available |

Not Available |

Not Available |

Section 32(1)(iia) - Additional Depreciation |

Not Available |

Not Available |

Not Available |

Not Available |

Section 32AC - Deduction for investment in new P&M |

Not Applicable |

Not Available (expired) |

Not Applicable |

Not Applicable |

Section 32AD - Deduction for investment in new P&M in notified backward areas |

Not Available |

Not Available |

Not Available |

Not Available |

Section 33AB - Deduction for deposit in case of Tea, Coffee and Rubber Development Account |

Not Available |

Not Available |

Not Available |

Not Available |

Section 33ABA - Deduction for deposit in Site Restoration Fund |

Not Available |

Not Available |

Not Available |

Not Available |

Section 35(1)(ii) / 35(1)(iia) / 35(1)(iii) / 35(1)(2AA) - Deduction for amount paid towards Scientific Research |

Not Available |

Not Available |

Not Available |

Not Available |

Section 35(1)(2AB) - Deduction for expenditure towards inhouse R&D |

Not Applicable |

Not Available |

Not Available |

Not Available |

Section 35AD - Deduction for expenditure on Specified Business (Cold chain, Infrastructure, etc) |

Not Available |

Not Available |

Not Available |

Not Available |

Section 35CCC - Expenditure on agricultural extension project |

Not Available |

Not Available |

Not Available |

Not Available |

Section 35CCD - Expenditure on Skill Development Project |

Not Applicable |

Not Available |

Not Available |

Not Available |

Chapter VIA Deductions |

Not Available Except: 80JJAA (deduction for employment generation) & 80CCD(2) - Employer contribution to Pension Fund |

Not Available Except: 80JJAA (deduction for employment generation) |

Not Available Except: 80JJAA (deduction for employment generation) & 80M Deduction for Dividend |

Not Available Except: 80JJAA (deduction for employment generation) & 80M Deduction for Dividend |

Set-off of carry forward loss / depreciation attributable to above deductions not allowable |

Not Available |

Not Available |

Not Available |

Not Applicable |

Salary related Sections 10(5) - LTA, 10(13A) - HRA, 10(14) - Special Allowance, Section 16 - Standard Deduction & Profession tax |

Not Available |

Not Applicable |

Not Applicable |

Not Applicable |

Section 57(iia) - Deduction for Family Pension |

Not Available |

Not Applicable |

Not Applicable |

Not Applicable |

Section 10(32) - Deduction for minor income clubbed |

Not Available |

Not Applicable |

Not Applicable |

Not Applicable |

Section 24(b) - Interest deduction for Self-occupied property |

Not Available |

Not Applicable |

Not Applicable |

Not Applicable |

Loss on House Property |

Not Available |

Not Applicable |

Not Applicable |

Not Applicable |

Disclaimer: The views expressed in this article are the personal views of the authors. The views / the analysis contained therein do not constitute a legal opinion and is not intended to be an advice. The authors may be reached at shashikumar@sduca.com and abhiseksaraogi@sduca.com

Deferment of Tax Payment on Exercise of Employee Stock Option Plan for Start-ups

ESOP has always been the significant component for compensation of the employees especially for the start-ups which in the initial years do not have enough profits to give lucrative pay package to the skilled work-force. It gives employees ownership interest in the firm. They help attract and retain talent, create more engaged employees, and provide a cost-effect company benefit.

It has been a long-standing demand from the start-up community to change the rules for ESOPs, which meant employees had to pay tax at the time of allotment of securities.

FinMin Nirmala Sitharaman's second Union Budget aims to change all that. In her Budget 2020 speech, the finance minister said that during their formative years, start-ups generally use ESOPs to attract and retain highly talented employees. “Currently, ESOPs are taxable as perquisites at the time of exercise, and this leads to cash flow problem for employees who continue to hold them for the long term.”

It is important to note is that as per the Income Tax Act, 1961, employees who are allocated ESOPs are taxed at two stages: first when they exercise the option to buy the shares or allotment on completion of vesting period (upon allocation), and second when they choose to sell the shares.

During the first stage, the difference between the exercise price and the fair market value of ESOPs is treated as a benefit under the income from salary (perquisite value). The fair market value per share minus exercise price per share multiplied by number of shares is taxed. In the second stage, the transaction of the sale attracts capital gains tax. This can be long term or short term, depending on the holding period (starts from allocation date). The periods are different for listed and unlisted shares.

In the present budget, the FinMin has proposed deferring the tax payment by 48 months, or until employees leave the company, or when they sell their shares—whichever is earlier. This has been proposed to improve the cash flow position of the employees so that they don't have to bear the tax burden immediately on allotment of shares or securities. This has been given effect by proposing to insert sub-section (1C) in section 192 of the Act.

Illustration

Suppose your company has offered 100 options in the ESOPs Scheme to you on 01.04.2020. The vesting period is 3 years and the exercise period is 1 years. The Exercise Price (i.e. the price which you have to pay) is Rs. 100. The actual price of the share in exercise date is Rs. 500

Vesting 3 years Exercise Period 1 year

Grant Date <----------------> Vesting Date <----------------> Expiry

As per the existing law, at the end of year 3 the employee shall exercise the option by paying exercise price and become the owner of 100 shares. The perquisite taxable in the hands of employee in the year of allotment of shares shall be Rs.40,000 (100 Nos. * Rs400).

Now as per proposed amendment, the employee of the start-up has to pay tax on such perquisite earlier of the following:

1. After expiry of 48 months from end of relevant assessment year i.e. in FY 2026-27

2. From the date of sale of specified security

3. From the date of which assessee ceases to be employee of the person

When the employee sells his shares says Rs.650, the profit arising on such sale shall be considered as capital gain in the hands of the employee. The cost of acquisition shall be the price of the share or security on the exercise date on the basis of which perquisite has been computed i.e. Rs.500. the capital gain shall be Rs.150 (650-500).

It is important to note that this is only timing difference on taxing the benefit received which has already been freezed at the time of allotment of shares based on market price on the date of exercise and taxed on the basis of rates in force of the financial year in which said share or security is allotted or transferred. Deferment of tax to future date shall not change the perquisite value to be added in employee salary computed at the time of exercise of the option.

This is a welcome move by the FinMin in order to improve the cash flow position and relaxation in making compliance in tax deduction for employers. But the industry and other stakeholders have expressed their concern as this amendment only takes care of eligible start-ups and does not include other than eligible start-up which are also facing the same cash flow problem.

Eligible start-up is defined in Section 80IAC of the Income Tax Act 1961 to mean-

"eligible start-up" means a company or a limited liability partnership engaged in eligible business which fulfils the following conditions, namely:—

(a) it is incorporated on or after the 1st day of April, 2016 but before the 1st day of April, [2021];

(b) the total turnover of its business does not exceed twenty-five crore rupees [in the previous year relevant to the assessment year for which deduction under sub-section (1) is claimed]; and

(c) it holds a certificate of eligible business from the Inter-Ministerial Board of Certification as notified in the Official Gazette by the Central Government;

The conditions of being treated as eligible start-up has also been proposed to be changed in this budget. It has been proposed to amend clause (b) to increase the turnover limit from existing Rs.25 Cr to Rs.100 Cr to include more companies within the definition of eligible start-ups and avail the benefit of deferment of tax on ESOP.

This new announcement only applies to start-ups incorporated after April 2016, as per the fine print in the finance bill. The Finance Bill states that this applies to employees of the companies, which qualify as eligible start-ups under section 80-IAC. To be eligible under Section 80-IAC, start-ups have to get a certificate from an inter-ministerial board.

This provision, industry members said, will leave out a large section of the start-up economy from the jurisdiction of the new rules. While there are close to 28,000 start-ups recognised by the DPIIT, the number of start-ups certified by an inter-ministerial board are far fewer at about 200, as per industry members.

Start-ups were hoping for a removal of double taxation and wanted ESOPs to be taxed only at the time of sale. This, however, has not changed, with the finance minister only announcing a deferment of the taxation from the time of exercise.

It is great to see the Government acknowledging and addressing the anxiety around ESOP taxation but limiting it to factors such as turnover of ₹100 crore, 5 years of employment or when the employee leaves the company might not fully solve the problem.

The Finance Bill describe the amendment to Section 156 of the Income-tax as such - Where the income of the assessee of any assessment year, beginning on or after the 1st day of April 2021, includes income of the nature specified in clause (vi) of sub-section (2) of section 17 and such specified security or sweat equity shares referred to in the said clause are allotted or transferred directly or indirectly by the current employer, being an eligible start-up referred to in section 80-IAC, the tax or interest on such income included in the notice of demand referred to in sub-section (1)shall be payable by the assessee within fourteen days--(i) after the expiry of forty-eight months from the end of the relevant assessment year; or (ii) from the date of the sale of such specified security or sweat equity share by the assessee; or (iii) from the date of the assessee ceasing to be the employee of the employer who allotted or transferred him such specified security or sweat equity share, whichever is the earliest.”

Corresponding amendment also made in Section 191 and Section 140A to give effect to the amendment in in Section 192 of the Act.

Through all these amendments in main section and corresponding amendment in incidental sections, clarity has been provided regarding the taxability in the hands of the employee or assessee. The issue of allowance of ESOP expense in the hands of employer has not been addressed, which has also been subject matter of litigation in the past. The difference between the market price and the exercise price, use to claimed by the employer as compensation to the employees u/s 37 to be spread over the vesting period. Employers use to claim proportionate ESOP expense during the term of the ESOP and make necessary adjustments at the time of actual issue of shares or securities. Revenue authorities always challenge or question the timing of allowance of such expenses to the employer- whether on proportionate basis during the term of the ESOP, or at the time of actual issue of shares when the perquisite is taxable in the hands of employee. This issue of litigation has more or less acquired finality through various ITAT and High Court decisions in case of Banglore ITAT (SB) in case of Biocon Ltd. Delhi HC in case of CIT vs. Lemon Tree Hotels Ltd , Madras HC in case of CIT vs. PVP Ventures [ITA NO. 1023 OF 2005] [TS-514-HC-2012(MAD)-O] , Mumbai ITAT in case of Sterlite Technologies Ltd.[ITA 4841/Mum/2013] .

However, there may be another litigation on allow ability of expense after this amendment, as to whether allowance of expense in the hands of employer shall also be deferred along with this amendment in deferment of taxing the perquisite in the hands of the employees.

The government should come with clarification regarding not to disturb the already settled position for allowability of ESOP expense which has acquired finality through various rulings.

[The article is co-authored by Anubhav Jaggi (Manager, Taxation Services)]

Budget 2020 : A Mixed Bag with some Hits and some Misses

The Honorable Finance Minister, Ms. Sitaraman presented the Union Budget 2020 on 01 February 2020, the second full term Budget of the current government after winning its second term in the 2019 general elections.

With the economy needing an impetus in the backdrop of low consumption, low investments and slowing GDP growth rate, the Finance Minister presented the Budget around three prominent themes - Aspirational India, Economic Development and Caring Society.

The Finance Minister focused on various areas for achieving the above themes. Big growth push on the back of launching infrastructure projects of almost INR 103 Lakh Crores under National Infrastructure Pipeline over a period of 5 years, a New Logistics Policy to be announced soon, accelerating construction of highways, a New Education Policy to be announced all seem to indicate a positive intent to create the right growth levers. Implementation however will be a significant challenge. Another key area was in the area of technology and startups, encouraging manufacture of mobile and electronic equipment in India, allocation of INR 8,000 crores over a period of 5 years in the Mission on Quantum Technology, establishment of seed funds, investment clearance and advisory cell, etc. With respect to mobilization of funds, the developments on the major disinvestment announcements would be closely watched.

The announcement of increasing the investment limit for foreign portfolio investors from 9% to 15% in corporate bonds is considered a big positive move. The move along with the exemption given to Sovereign Wealth Funds on their investments in sectors like infrastructure is expected to revive foreign investment.

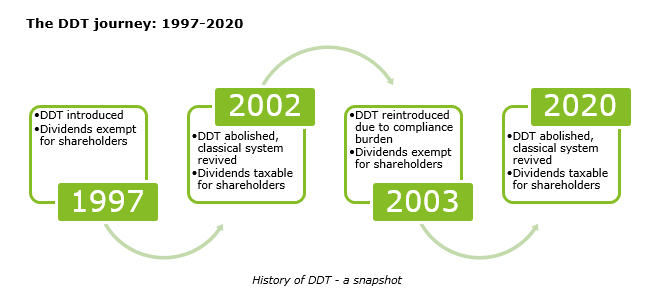

The long-standing demand to do away with the Dividend Distribution Tax ('DDT') which an Indian company/ mutual funds are required to pay while declaring dividend has been accepted. The removal of DDT by the Government has been welcomed by investors, corporates. The dividend income would now be taxed in the hands of the recipient of the dividend income, a move which is expected to boost investment. Many foreign investors would be benefitted by this amendment given that the double taxation avoidance agreement between India and the country of which the foreign investor is a resident has rate of taxation of dividend lower that the current DDT rate.

Like for Companies in September 2019, the Government has tweaked the tax rates for individuals. A new tax regime is proposed by introducing revised income tax slabs for individuals/ HUFs as well wherein an individual/ HUF can opt in to be taxed at lower rates provided they do not avail any exemptions/ deductions. It would be interesting to see how many tax payers opt into the new regime and one would have to undertake a comparative analysis of tax liability under the old regime (with exemptions and deductions) and the new regime (without any exemptions and deductions) to take a decision. As per experts, whether this would increase spending / consumption remains to be seen. The continuation of the additional INR 1.5 lakh deduction for the principal repaid on housing loan for one more year is good news for the real estate sector.