Budget Wishlist

Dialogue on Reforms for Smoother Corporate Restructuring

This article has been co-authored by Dipesh Jain (Director) and Smeet Jain (Deputy Manager), Deloitte Haskins and Sells LLP

The COVID-19 pandemic has wreaked havoc across the world, affecting major businesses globally. Business leaders across the globe, by and large, are struggling to predict and accurately assess the impact of the pandemic on their businesses, including on market situations as well as on people.

Mergers & Acquisitions (M&A) activities were also gravely impacted during the initial period of COVID-19 and are now slowly moving towards the recovery phase to some extent. It is expected that as businesses tread beyond recovery, M&A activity will likely thrive too.

It is pertinent to note that all eyes are on Budget 2021 now; especially given that the government is keen on providing boost to the economy which should logically include M&A activities and securities market as well; a US$ 5 trillion economy would surely require this level of support from the government.

Some key expectations from an M&A and corporate restructuring standpoint are as follows:

1. Carry Forward of Losses

1.1 Carry forward of loss in the case of amalgamation of companies NOT owning ‘industrial undertaking’

- As per the provisions of the Income-tax Act, 1961 (ITA), losses attributable to the Demerged Undertaking are available in the hands of the Resulting Company. Going by the same intent and logically speaking, losses of amalgamating companies should be available in the hands of the amalgamated companies – mergers and demergers should be on similar footing and there is no reason to have a disadvantageous tax treatment for mergers as compared to demergers.

- Accordingly, accumulated losses should be available in the hands of the amalgamated companies without the need to single out only the entities which satisfy the condition of owning an “industrial undertaking”.

- This would, inter-alia, encourage consolidation, growth and make India a competitive country for foreign investments. This would also, in a way, ensure creating / sustaining employment opportunities; especially in cases where the amalgamating companies would otherwise not have been able to carry on the business, if it were not to be for consolidation with other entity(ies). At the least, section 72A of the ITA should be widened to include – e.g. - real estate / infrastructure / capital intensive service sectors such as tower companies, Direct to Home operators, entertainment industry, etc. within its fold.

1.2 Carry forward of losses in case of change in shareholding

- Change in shareholding typically takes place on account of capital infusion in the company by a new investor or change in management where the existing promoters dilute in favor of new set of promoters to run the company.

- In either case (i.e. primary infusion of funds or secondary exit), the critical considerations are primarily one of the following – (i) revival of the existing company (ii) expanding the outreach of the operations (iii) sustaining competition in the marketplace (iv) technological advancement; or (v) providing superior quality output / curtailing costs to provide cheaper products.

- It is to be noted that any primary / secondary transaction in the capital market ultimately leads to economic advancement for the country as a whole in some way or the other – be it (i) employment generation, or (ii) favorable cross-border trade, or (iii) better goods and services to the population at large in terms of better quality products or cheaper products, or (iv) higher taxes in terms of increased economic activity, and the like.

- In light of the benefits which could be achieved in terms of this kind of M&A activities, especially in the difficult sectors / companies which are into persistent losses or with long gestation periods, it would be prudent not to expose the losses in such companies, just on account of change in shareholding.

- Deletion of Section 79 of the ITA would definitely attract a lot of M&A activity in the troubled companies, which in turn would strengthen the economic activity in the country.

2. NCLT Approved Schemes of Arrangement

2.1 Applicability of section 56(2)(viib) in case of issue of shares upon merger/ demerger

- Due to court-approved amalgamations or demergers, non-cash transactions get tax neutrality benefits on meeting prescribed conditions. However, while issuing shares pursuant to such amalgamations or demergers, there is no specific exemption on the applicability of the super-premium rule under the section 56(2)(viib) of the ITA, which can potentially distort the intended overall tax neutrality concept for such schemes of arrangements.

- There is a specific carve out for NCLT approved schemes complying with merger / demerger conditions from the wrath of section 56(2)(x) of the ITA as well.

- In light of the above, appropriate clarification is required to exclude non-cash transactions arising out of a merger or demerger, which is otherwise tax neutral, from the purview of the section 56(2)(viib) of the ITA.

2.2 Cross-border M&A transactions

- Tax neutrality benefits, which are otherwise available in case of a merger / demerger of any Indian company into another Indian company i.e. domestic transactions, have not been extended to transactions arising on account of similar outbound cross-border transactions.

- This has been one of the disincentives for Indian promoters considering cross-border deals (in spite of a smooth regulatory process carved out for such cross-border arrangements). A specific tax exemption ought to be provided for such transactions to enable flawless cross-border mergers and demergers to enable Indian companies to be competitive and stand out in the global arena

3. LLP Structure

3.1 Merger / Demerger of Limited Liability Partnership

- While Limited Liability Partnerships (LLP) have been recently promoted as a form of organisation – with liberalisation in the FDI regulations as well – certain tax and regulatory relaxations are still required to bring it on par with the corporate structure, especially as regards consolidations and carve-outs.

- LLP vehicles, which have been popular among small and medium enterprises and service-oriented businesses, could flourish well in case re-organisations (such as merger / demerger with other LLP/companies) are expressly permitted under the regulations. There is a need to extend tax protection and benefits as well (such as enabling carry forward of tax losses and providing tax neutrality) to LLPs and their partners undergoing re-organisations. This is more so required now as during the pandemic, many such small and medium enterprises have had to endure a lot; the flexibility to join hands with similarly placed entities will help them to face the challenges thrown by the pandemic and ensure continuity of operations.

- It is recommended that benefits of section 72A of the ITA be extended to merger and demerger undertaken between LLPs. This will facilitate the ease of doing business and create a desirable business atmosphere for companies and LLPs and bring the tax treatment for such transactions at par with that available to Indian companies on similar transactions.

3.2 Conversion of LLP into Company

- Shareholders are protected as regards conversion of “company into LLP”, however no specific exemption is provided to partners of an LLP in case of conversion of “LLP into company”.

- It is recommended that section 47(xiii) of the ITA be brought in line with provisions of section 47(xiiib) of the ITA, by providing specific exemption to partners pursuant to conversion of LLP into a corporate structure.

4. Other Asks

4.1 Relaxation from gift taxation provisions pertaining to acquisition of stressed assets undergoing insolvency process

- Pursuant to the pandemic, there is apprehension of a rise in the number of corporates likely to face Insolvency and Bankruptcy Code (IBC) proceedings. Under the current law, acquirers of shares in companies pursuant to such IBC proceedings are subject to tax on account of potential valuation adjustments. To address this issue, the scope of transactions, being currently excluded from the purview of section 56(2)(x) of the ITA, ought to be extended to cover transactions that are undertaken in line with a resolution plan approved by the National Company Law Tribunal (NCLT).

- Similar relaxation for IBC related cases should also be provided under section 50CA and 56(2)(viib) of the ITA which are more of anti-abuse provisions.

4.2 Rationalisation of Tax Collection at Source (TCS) applicability in certain cases

- TCS exemption availability only to listed shares have created a stir in the M&A market.

- Shares and securities which are part of any M&A transaction are subject to TCS even if the buyer is not carrying on any business in India. There is an urgent need to address this aspect, else while TCS is collected, the same would have to be refunded with interest by the Government.

- In light of this, suitable amendments should be brought about to keep transactions in securities outside the ambit of section 206C(1H) of the ITA.

4.3 Exemption from capital gains on indirect transfers within the group as part of re-organization

- It is recommended that specific provisions be introduced for exempting intra-group transfers as part of group re-organizations from the indirect transfer provisions.

4.4 Taxability of deferred considerations

- Taxability on gains arising on account of deferred consideration is a matter of protracted litigation.

- It should be clarified that deferred consideration, especially consideration, which is contingent in nature, will only be taxed in the year of receipt of such consideration in the hands of the seller.

Concluding remarks:

The government has been highly proactive during the pandemic and has tried to resolve the bottlenecks in various areas all this while. It has also been agile in various other areas on the tax front in the recent past – to name a few – Vivad se Vishwas, faceless assessments, e-invoicing under the GST regime, etc. Various timely measures have been taken by the government during last three quarters (of the pandemic) –promoting public expenditure, keeping IBC in abeyance, extending the due dates for various filings, providing moratorium periods for borrowings, reducing withholding tax rates – just to name a few.

It will be extremely helpful and opportune if the government now provides certain relaxations as discussed above, which would offer the much-needed impetus to the struggling economy to enable businesses to find their feet through restructuring / combinations with other similarly placed entities.

A traction on the mergers and acquisitions front would definitely push economic activity, including provide positive vibes amongst the offshore investors looking at India as an investment destination. Hopefully the trend of the government’s bold strides in the recent past would continue and we would get to see the same in the much-awaited Union Budget 2021.

Provision for bad and doubtful debts is typically not tax deductible except in case of specified financial institutions including banks, where such provisions are allowable, subject to limits as deduction while computing taxable income [section 36(1)(viia) of the Income-tax Act, 1961 (the Act)].

Bad debts written off as irrecoverable in the accounts of the taxpayer are typically tax deductible [section 36(1)(vii) of the Act] but in case of specified financial institutions, it is allowed to the extent it exceeds the amount allowed as deduction for provision for bad and doubtful debts under section 36(1)(viia) of the Act.

Further an explanation was inserted by the Finance Act 2001 with retrospective effect from 1 April 1989, under section 36(1)(vii) to clarify that any bad debt or part thereof written off as irrecoverable in the accounts shall not include any provision for bad and doubtful debts made in the accounts.

Banks also have a concept of technical write off of bad debts where the individual loan or debts are not written off in the branch accounts but done so in the head office books of accounts. The Reserve Bank of India (RBI) requires banks to disclose technical write off separately in its financial statements vide RBI Master Circular dated 1 July 2015 on “Prudential norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances”.

The purpose of giving this background is to understand the context in which the Supreme Court passed the order in the case of Vijaya Bank vs. CIT [2010] [TS-120-SC-2010-O] (SC).

The questions that arose for determination before the SC concerned the manner in which actual write-off takes place and whether it is imperative for the assessee bank to close the individual accounts of each debtor in its books or whether a mere reduction in the "Loans and Advances Account" or Debtors to the extent of the provision for bad and doubtful debt is sufficient?

The matter related to the Assessment Years 1993-94 and 1994-95 i.e. post amendment by the Finance Act 2001.

The SC referred to the decision of the division bench of the SC in the case of Southern Technologies Ltd. v. Jt. CIT [2010] [TS-5003-SC-2010-O] wherein it was held that prior to the amendment even a provision could be treated as a write-off. However, after April 1, 1989, a distinct dichotomy has been brought in by way of the said explanation to section 36(1)(vii). So post April 1, 1989, a mere provision for bad debt would not be entitled to deduction under section 36(1)(vii). To understand the above dichotomy, one must understand 'how to write off'. If an assessee debits an amount of doubtful debt to the profit and loss account and credits the asset account like sundry debtor's account, it would constitute a write-off of an actual debt. However, if an assessee debits 'provision for doubtful debt' to the profit and loss account and makes a corresponding credit to the 'current liabilities and provisions' on the liabilities side of the balance-sheet, then it would constitute a provision for doubtful debt. In the latter case, the assessee would not be entitled to deduction after April 1, 1989."

The SC further noted that the assessee-bank has not only been debiting the profit and loss account to the extent of the impugned bad debt, it was simultaneously reducing the amount of loans and advances or the debtors at the year-end. In other words, the amount of loans and advances or the debtors at the year-end in the balance-sheet is shown as net of the provisions for impugned debt.

Thus the SC held that it was not imperative to close individual account of debtors to claim bad debts write-off.

Banks typically disclose under the asset side of the Balance Sheet in the annual accounts, the Loans and Advance and / or Debtors, net of Provision for bad and doubtful debts.

So would this mean that all provision for bad and doubtful debts are allowable as bad debts written off just because in the annual accounts the same is shown as net off against the Loans and Advance / Debtors?

The decision of the Supreme Court refers to the concept of head office account and rural branch account, and also refers to the fact that the head office account clearly indicates write-off of the loans and advances. It further mentions that the loans and advances or debtors at year-end is reduced against the provision for impugned debt. Would this imply that the SC was examining the concept of technical write-off of bad debt and not the general provision for doubt debts?

On reading the decision, it appears that the Supreme Court has held provision for impugned debt which is more akin to the technical write-off deductible as bad debt written off but not the general provision for doubtful debts. The decision of the SC in Vijaya Bank could be interpreted differently and so suitable amendment be made to the Act or a clarification be issued to avoid tax litigation.

Information for the editor for reference purposes only

Time to Dot the I's and Cross the T's

ESOPs Taxation: Start-ups are integral to our dream of a large and diversified economy. One of the biggest challenges faced by startups is hiring and retaining good talent. ESOPs bridge this gap by acting as an effective tool for this purpose. They also have the added advantage of creating a sense of ownership by employees within the start-up. ESOPs should be taxed in the hands of employees at the time of the actual sale or transfer, period. Current provision of timelines for presumed monetization of capital tables within 5 years or continuation of employment within a said start-up as conditions should be done away with for the purposes of deferment.

Furthermore, it will be ideal to recognize Stock Appreciation Rights (SARs) or Unit award agreements with underlying value linked to enterprise valuation or equity as equivalent to ESOP for the purposes of taxation, given the steadily increasing adoption rates by start-ups as preferred choices for incentives.

FEMA: All FX inflows and outflows continue to remain subjected to substantial reporting, limits procedures set by the RBI, which increases latency for closing transactions on both inward investments as well as outward returns either by way of original capital, interest, or dividends. There is an urgent need to eliminate procedures which do not add any reasonable value in terms of oversight, especially on capital transactions under the automatic route. Further, all efforts should be made to reduce compliance procedures associated with all FX transactions, as these end up becoming barriers to transactions.

Transfer Pricing: India continues to remain a preferred target for setting up captive centers. There is a general lack of clarity, especially amongst small and medium enterprises on the transfer pricing norms. The government should create the concept of “MSME Captive centers” (potentially with revenue cutoffs) and giving captive centers the optionality to price their contracts at margins mentioned under the tax code. Alternatively, the same can be achieved by way of generic APAs for standard service lines. Once applied, the tax code should assume that the pricing is on Arm’s length basis and de-risk the captive centers from further scrutiny under the TP norms.

Payroll: Socialist-era regulations related to employee payroll (for example Bonus, Gratuity) should be eliminated. Employers effectively consider all regulations under the CTC concept thereby resulting in the regulation adding compliance costs for employers and deferment of salary in the hand of employees. Further, the labor ministry should assess inviting tech platforms to build API for social service platforms like EPF/PPF/NPS/ESIC which can be then used by third party payroll processing systems to allow for direct deposit & filings or returns with the agencies. This will likely pave the way for creation of tech-based payroll systems & reduce compliance costs for businesses.

GST: Since its implementation in 2017, the GST Act and its associated procedures have become more complex with every passing year. It will not be untrue to say that the current system has overtaken the previous one in terms of complexity and added additional compliance costs for businesses.

Taxation Shot for Pharma Industry

This article has been co-authored by Salika Kothari (Manager), Rajeshree Sabnavis & Associates.

‘India’s pharma industry is an asset for entire world’, says PM Narendra Modi. The pharma industry has played a vital role in recent times while responding to the unprecedented COVID-19 crisis. This Article attempts to bring out the Direct Tax proposals that the pharma companies are looking forward to getting the much needed shot in the arm from the upcoming Budget 2021.

- Reintroducing weighted deduction for Research and Development (R&D) expenditures

Supporting the world’s battle against COVID-19, many pharma companies have engaged themselves in active research pumping in huge funds and taking on themselves massive risks. Section 35(2AB) of the Income-tax Act,1961 (the Act) had provisions relating to enhanced deduction for undertaking / making contribution for scientific research. Such R&D expenditure payments were earlier eligible for weighted deduction (ie more than 100%) in certain scenarios, which has been reduced to 100% from Budget 2020. As a one-time measure, the Government may consider restoring the weighted deduction in Union Budget 2021 to encourage pharma companies making contribution to R&D expenditures, which in turn will enable new discovery and innovation.

Further, at present, the R&D expenditure are being regulated by DSIR, which approves R&D expenditure as per its own standards. To reduce any ambiguity around the claim of R&D expenditure for tax purposes, it is recommended that Budget 2021 should restrict DSIR role to merely approving of R&D facility and expenditure claims from a tax point of view should be examined by the Income Tax authorities only.

- Improvising New tax regime

Budget 2020 had inserted two Sections namely Section 115BAA and 115BAB to grant benefit of a reduced tax rate to domestic companies. While the existing domestic companies have been provided an option to pay tax at a concessional rate of 22% (excluding surcharge and cess), new domestic companies set up on or after October 1, 2019, and commencing manufacturing before March 31, 2023, would have the option to pay tax at 15% (excluding surcharge and cess). The option to avail the reduced rate of tax is subject to fulfilment of certain conditions prescribed therein which, inter-alia, includes companies will not be able to take deduction of R&D expenditures incurred by them and donations made by them. Budget 2021 should allow deduction for R&D expenditures incurred by pharma companies and towards Covid-19 related donations made by pharma companies while calculating total income under the new tax regime. Also, the Government may consider expanding the regime to benefit not only entities engaged in the manufacturing space but also providing services to encourage players across the value chain and to create a conducive growth environment for the sector as a whole.

- Deductibility for COVID related expenses incurred by pharma companies

In the current scenario, many pharma companies have expended on additional safety measures, community welfare expenses or increased Corporate Social Responsibility (CSR) expenditure. Currently, Section 37(1) of the Act, disallows any expenditure incurred towards the CSR/ expenditure incurred not wholly and exclusively for the purpose of business or profession. Considering the impact that the pandemic has had on the business community at large and the need to continue with sustained efforts in this area, supporting the industry by way of a reduced tax impact on such expenditure is a much needed ask of the day, Accordingly, Budget 2021 should clarify that all expenses related to COVID-19, whether part of CSR or otherwise would be fully allowed as deduction under Section 37(1) of the Act.

- Widening scope of Patent Box Regime

The benefit of Section 115BBF of the Act, is restricted to ‘true and first inventor of the invention’ of patent developed and registered in India. It is recommended that Budget 2021 should be makeshift to allow application of the reduced tax rate even to assignees / transferees of the patent to encourage larger players like corporates and LLPs to invest in this space and not restrict such benefit to only the true and first inventor of the invention.

Further, with India’s desire to be recognized as a leading player in the global pharma space, restricting benefits to work done or patent registrations procured in India could prove to be counter-productive. Accordingly, to truly incentivize players in the Indian pharma space to go global, Budget 2021 should expand the benefits of Section 115BBF to patents developed and registered in foreign country also.

- Clarification on MCI Circular

As per Circular no 5/2012 dated August 1, 2012, issued by the CBDT, expenses incurred for providing freebies (gift, travel facility, hospitality, cash, or monetary grant) to doctors are inadmissible under Section 37(1) of the Act, as it violates MCI Regulations, 2002. MCI Regulations, bar doctors from accepting any gift, travel facility or cash grant from any pharma or allied healthcare industry in return for the referring, recommending, or procuring of any patient for medical, surgical, or other treatment. The taxpayers have been contending that the MCI Regulations do not apply to pharma companies and healthcare industry as they are code of conduct for healthcare professionals whereas, the tax department has been citing the same to disallow expenditure under Section 37(1) of the Act. This issue is highly litigative. The Government should issue a clarificatory circular that MCI Regulations are binding on health care professionals and not binding on pharma companies. Further, Government should constitute panel to define expenses that could be deductible by pharma companies under Section 37(1) of the Act to ensure a wide-spread investment being made by pharma companies to ensure that healthcare benefits are not restricted to a select community.

- Extension in reduction of Tax deducted at Source (TDS) rates

In order to increase liquidity in the hands of an individual who is already battling the financial distress due to COVID-19 pandemic, the Government vide Press release dated May 13, 2020, has reduced TDS and tax collection rates (TCS) rates by 25% for payment or credit made till March 31, 2021. With the effect of the pandemic still being felt across sectors, it is suggested that reduction in TDS rates on payment to residents may be further extended upto March 31, 2022.

- Abolishing TCS on sale of goods to reduce administrative compliances

The Government has levied TCS by inserting a new Section 206C(1H) of the Act, on sale of goods. As per the provision of Section 206C(1H) of the Act, tax is required to be collected at the rate of 0.1% (0.075% till March 31, 2021) by the seller, on sale of goods, if the sales consideration exceeds Rs. 50 lakhs from a buyer during the previous year. There are challenges being faced by taxpayers such as treatment of sales return and post-sale discounts in collection of TCS. Further, TCS provisions are very complex and time-consuming requiring updating the accounting and finance processes, collecting TCS from buyer, depositing with the Government and filing quarterly TCS returns. Considering that the Government is already entitled to collect taxes by way of advance tax from the income recipients, subjecting the industry to more time consuming and cost inefficient tax compliances, by way of TCS provisions, is a counter-productive measure. Hence, it is recommended that Budget 2021 should do away with the provisions relating to TCS on sale of goods.

- Guidelines on relaxation in domestic tax law to exclude number of days spent by employees of foreign companies in India

The tax residency status, in India, of an individual is dependent on the number of days that he or she stays in India and not on citizenship. Cross border movement of employees is severely impacted due to COVID-19 outbreak which has resulted in creation of permanent establishment exposure of foreign companies in India on accounts of stay of their employees in India. Budget 2021 should clearly issue guidelines on relaxation in domestic tax law to exclude number of days spent by employees of foreign companies in India due to exceptional circumstances beyond their control. While drafting the guidelines, the Finance minister could take aid from OECD Guidance released earlier this year, addressing the tax implications of employment changes arising due to COVID-19 pandemic involving cross-border workers. It has been recommended by OECD that the exceptional and temporary change of the location where employees exercise their employment because of COVID-19 crisis, such as working from home should not create new permanent establishment for the employer.

Concluding remarks:

The Government has been highly active during the pandemic and have tried to resolve issues in many areas in the recent past to name a few are introducing by Vivad Se Vishwas, extending due dates for various filings, reducing TDS rates. Given the impact of the pandemic, witnessed by the country and the world at large, a ‘Healthy Pharma Industry’ is the need of the hour. In addition to the steps already taken by the Government, the above measures will go a long way in fortifying the position of the Pharma companies both in India and globally.

Taxability of Interest Ex-gratia – Need for Clarity

The Government of India has provided significant relief to the public in general in view of the COVID-19 pandemic that has affected the Indian economy and people. Some of the relief measures could have income-tax implications and may necessitate amendments in law / clarifications.

In view of the extreme COVID 19 situation, the Government of India, has approved the scheme for grant of ex-gratia payment of difference between compound interest and simple interest for six months to borrowers for specific loan accounts[1].

The object of the scheme was to provide relief for the period from 1 March 2020 to 31 August 2020, to eligible borrowers, through lending institutions. Such payment does not constitute a contractual, legal or equitable liability of the central government and is only an ex-gratia payment to the designated class of borrowers in view of the COVID-19 pandemic. All banking companies registered with RBI have been advised to ensure that the ex-gratia amount payable under the scheme should be credited to the account of the eligible borrowers, on or before November 5, 2020. Post this, banks can lodge their claim for reimbursement latest by December 15, 2020 with the central government through the State Bank of India (SBI). Borrowers in certain segments/classes of loans (e.g. MSME, education, housing, consumer durable, credit card dues, automobile, consumption and personal loan to professionals), who have loan accounts having sanctioned limits and outstanding amount of not exceeding Rs.2 crore (aggregate of all facilities with lending institutions) as on 29 February 2020, were eligible under the scheme.

Any borrower whose aggregate of all facilities with lending institutions was more than Rs.2 crore (sanctioned limits or outstanding amount) was not be eligible for ex-gratia payment under the scheme. The account should not be a Non-Performing Asset (NPA) as on 29 February 2020. Further the ex-gratia payment should be admissible irrespective of whether the eligible borrower had fully or partially availed or not availed of the moratorium on repayment announced by the RBI.

A question arises whether the said ex-gratia payments should be taxable income for the borrower.

The term ‘ex-gratia’ has not been defined under the Income-tax Act, 1961 (the ITA or the Act) and so reference may be made to the general meaning of this term. Ex-gratia is generally understood as given as a favour or from a sense of moral obligation rather than because of any legal requirement (Oxford language).

Income has been defined under the Act to inter alia include “assistance in the form of a subsidy or grant or cash incentive or duty drawback or waiver or concession or reimbursement (by whatever name called) by the Central Government” [Section 2(24)(xviii) of the ITA]. The said clause was inserted by the Finance Act, 2015 w.e.f. 1 April 2016.

Circular no. 19/2015 explaining the provisions of the Finance Act 2015 provides the intention of introducing the above clause so as to align the Act with the Income Computation and Disclosure Standards (ICDS). It also clarifies that “5.2 As mentioned in Press Release dated 5th May, 2015, the amended definition of income shall not apply to the LPG subsidy or any other welfare subsidy received by an individual in his personal capacity and not in connection with the business or profession carried on by him.”.

ICDS VII deals with government grants and is applicable only in case of income computed under the head, ‘Profits and gains from business or profession’ and ‘Income from other sources’ in case of all taxpayers, except for individuals and HUF, who are not required to get their accounts audited under the Act.

Section 10 of the Act which deals with income not chargeable to tax, earlier provided for income which was of casual non-recurring nature of less than Rs 5000, as exempt from tax, subject to such income not arising from business or profession or services. This exemption has since been deleted.

Section 56 of the Act, inter alia provides that where any person receives, in any previous year, from any person or persons, any sum of money, without consideration, the aggregate value of which exceeds fifty thousand rupees, the whole of the aggregate value of such sum should be taxable as income from other sources.

The Supreme Court in the case of Padmaraje R. Kadambande v. CIT [1992] [TS-5024-SC-1992-O] (SC) has held that “Section 2(24) defines in an inclusive manner what 'income' is. The word 'income' connotes periodical monetary return coming in with some regularity or expected regularity from definite sources. In the facts of this case, the assessee continued to receive cash allowance as compassionate payment from the government post discontinuation of monthly cash allowance after the merger of Kolhapur State in the then state of Bombay. The SC held that there was no compulsion on the part of the government to make the payment since it was purely discretionary. The payment made by the government was undoubtedly voluntary. However, it had no origin in what might be called the real source of income. Further, it was compassionate payment, for such length of period as the government may, in its discretion, order. In view of the above, the amount received by the assessee, was held as a capital receipt and, therefore, was not income within the meaning of section 2(24).”

The ex-gratia scheme is applicable only to certain eligible borrowers that meet the specified conditions as per the scheme. Such payment does not constitute a contractual, legal or equitable liability of the Central Government. Also, the intention of the grant is to provide financial support to individuals. In such a scenario, a question arises as to whether the ex-gratia should be treated as income in the hands of the borrowers and if so, whether the financial institutions would be required to withhold tax on such waiver of interest. If so, it shall result in additional tax burden on the borrowers who would already be struggling with the economic crisis due to the pandemic.

Since the issue is subject to interpretation, a clarification to this effect or insertion of an additional provision in the Act on the taxability of such ex gratia payment would be helpful keeping in mind simplification and certainty in tax laws.

Information for the editor for reference purposes only

Alifya Hakim is Director and Lovina Mathias Daniel is Manager with Deloitte Haskins & Sells LLP

[1] Ref no. F. No. 2/12/2020-BOA.I dated 23 October 2020 and RBI vide Circular No. RBI/2020-21/61 DOR. No. BP.BC.26/21.04.048/2020-21 dated October 26, 2020

Budget Expectations 2021 – Corporate Restructuring

This article has been co-authored by Damini Dhull (Senior Associate), Nangia & Co LLP .

Budget Expectations 2021 – Corporate Restructurings

As the world copes with the uncertainty of the Covid-19 pandemic, India Inc. too, has been working overtime, formulating its response to the crisis. With the wheels of economic growth grinding to a halt, the pandemic has mutated into an economic crisis. The high impacted sectors in terms of risk on account of Covid-19 are aviation, hotels, restaurants, shipping, ports and port services. The medium impact sectors are automobiles, building material, residential real estate while low impact sectors include education, dairy products, FMCG and healthcare. COVID-19 has impacted varied industries alike resultantly restricting the feasibility of mergers and acquisitions including inbound foreign investments in India. The global and domestic economic disruption has caused delay (in several cases indefinitely) in completing may trade transactions. The global supply chain fallout and restricted international borders have forced investors to take a relook at the valuation of the assets underlying the ongoing and future deals. This unprecedented environment has also triggered a need for a deeper due diligence exercise to assess closely and identify the underlying vulnerabilities to COVID-19 and its economic impact.

With this as a backdrop, there are high expectations from the finance minister to present a growth oriented budget which can help boost economic activity which is wheeling under the effects of COVID-19 pandemic. Some of our key expectations from Budget 2021 are as under:

- Extending Section 72A benefits to Service Sector Companies

The services sector is not only the dominant sector in India's GDP, but has also attracted significant foreign investment flows, contributed significantly to exports as well as provided large-scale employment. Acting as the key driver of India's economic growth, this sector has contributed 55.39% of India's Gross Value Added in FY2020. Accordingly, the lawmakers should recognize the importance of promoting growth in services sectors and providing incentives therein. Considering the same, the ministry should Extend benefits of carry forward of losses under section 72A of the Act to all sector companies especially to service sector companies. The necessary amendments should be made in Section 72(A)(2) and Section 72A(2)(b) as well.

- Tax Neutrality for Outbound Mergers

Presently company law and FEMA permits merger of Indian companies with global corporates. However, the Income Tax act does not provide for tax neutrality with respect to such outbound mergers. It is recommended that appropriate amendments are made in the Income Tax law to provide for tax neutrality in relation to such outbound mergers. This would act as a big incentive for Indian promoters considering cross-border acquisitions / mergers and the economy would witness more and more of global M&A which is the need of the hour.

- Deferred/Contingent Considerations

The increase in risk premium owing to the novel Covid-19 has re-opened negotiations of term sheets and in several cases transaction documents. Investors are now preferring tools like deferred consideration and earn-outs which permit a ‘wait and assess before you fully invest’ approach, which is gaining more popularity in M&A structuring. Therefore, it’s important that the tax laws provide for necessary clarity in respect of taxation of such deferred or contingent consideration, and ensure that there is no taxation upfront on such deferred considerations.

- Rationalization of Section 56(2)(viib) provisions

The provisions of Section 56(2)(viib) were introduced for taxing excessive share premiums by a closely held company upon the issue of shares. The intent of the legislature in enacting the provisions of this section was to discourage the practice adopted by tax payers of subscription to shares of closely held companies at excessive and unjustifiable premium, however this taxation has thwarted angel investment activities as well as HNI investment in private companies who are in need of private investor funds for expansion. In view of the same, its recommended that provisions of Section 56(2)(viib) be rationalized such that its application is only in cases of intended situations of potential money laundering.

- Insolvency and Bankruptcy Code (IBC)

While the Insolvency and Bankruptcy Code (IBC) has been lauded as a commendable move by the government for providing resolution mechanism for sick companies, the tax cost still acts an impediment. Though the Minimum Alternate Tax (‘MAT’) provisions have been amended to provide deduction of losses including depreciation to such companies, book profits arising from waiver of debt as a result of haircut taken by lenders result in high MAT cost—a major bottleneck in the resolution process. Such haircuts should be specifically exempted from the levy of MAT. Also, acquisition of shares of a company undergoing insolvency resolution process under IBC should also be exempted from taxation under the deeming fiction of section 56 of the Income-Tax Act. Further, considering that the main objective of a resolution plan under the IBC is to maximise the value of assets of the company undergoing insolvency resolution process and thereby for all creditors, in any case, a specific carve-out should be provided under General Anti-Avoidance Rules (GAAR) for any transaction undertaken as a part of the resolution plan.

- Conversion of Partnership Firm/LLP into Company

When an Indian partnership firm or LLP gets converted into a company or vice-versa there are many conditions attached to make it tax neutral one such condition is the continuity of shareholding. It is recommended that such post conversion conditions (of continuation of shareholding etc) ought to be relaxed, so that smaller organizations will have more opportunities for fund raising as well as growth.

- Other Suggestions for enabling corporate restructuring include-

- Ensuring uniformity in stamp duty across India for Scheme of Arrangements approved by the National Company Law tribunal.

- Provide clarity to settle the ambiguity under carry forward and setoff of losses under intra group reorganizations where the ultimate (beneficial owner) remains the same.

- Providing shareholder level exemption in case of indirect transfer of shares of Indian company in cases of merger or demerger of foreign companies

- Providing clarification or express exemption for schemes sanctioned by NCLT from GAAR provisions to reduce widespread litigations.

- Benefit of clause (iv) and (v) of Section 47 to be extended to step down subsidiaries where the parent company holds whole of share capital of such subsidiary directly or through other 100% held subsidiary.

- Clarification on tax neutrality in case of demergers, where the demerged assets and liabilities are recorded at fair value in line with accounting mandate under Indian Accounting Standards (IndAS).

- Specific provision enabling revision of tax returns to give effect to the scheme of arrangement even after the due date of filing revised returns, especially considering the amended curtailed timelines for revision of return.

Post Covid-19 pandemic, the economy has certainly moved from abject hopelessness to a level of renewed confidence that India would get back on track to be among the fastest growing economies by financial year 2021-22 (FY22)-end. In the backdrop of the same, the government should deliver an impetus-oriented budget which would act as the starting point for picking up the pieces after the economic disruption post COVID carnage. The budget should ensure that the positive sentiment translates into economic momentum, supporting India’s journey to becoming a US$ 5 trillion economy by 2025. Corporate restructuring has always played an important role in a growing economy. Therefore, the government must take some positive, if not bold, measures while formulating the fiscal and tax policies for 2021 to incentivise mergers and acquisitions (M&A) deals and make the reorganisation of businesses less taxing.

Union Budget 2021 - A Case for Some Much-Awaited Tax Incentives!

This article has been co-authored by Thangadurai V. P. (Principal Associate) and Reema Arya (Consultant), Cyril Amarchand Mangaldas.

Expectations on Union Budget 2021: A case for some much awaited tax incentives!

The year 2020 has been an unusual year for the world in more than a century. The economies across the world have been marred on account of COVID-19 pandemic and the economic slump being experienced worldwide at present has been unprecedented in every way. India is no exception.

Due to an unprecedented 23.9%[1] drop in the GDP growth in the first quarter and the resultant shortfall in the tax collections, there is an unimaginable pressure on the Government to incentivise the industries so that the economy could be revised at the earliest. However, the Government is simultaneously experiencing a huge shortfall due to falling tax collections that has curtailed the room for maneuvering in a big way. While the tax collections have suffered a serious deficit, the Government is hoping to make some windfall through the amnesty scheme - Vivad se Vishwas Act, 2020.

The union budget for 2021 to be presented by Ms. Sitharaman is just a few days away and all eyes are on the tax and other finance proposals to be included in the Finance Bill. While the business world looks up to the forthcoming budget to rejuvenate the economy, the Government will have its task cut-out to balance the serious depletion of tax collections vis-à-vis the never-ending industry expectations. There is unanimity amongst most leading economists that getting India back to the growth path is more important than worrying about tax collection shortfalls.

In this article, we have tried to identify certain aspects that the FM may bring out in the Budget 2021:

(A) Provisions to ease the stress created by COVID-19 pandemic:

In order to kick-start the recovery phase to bring the economy out of the COVID-19 pandemic induced problems, it is important that certain tax provisions are eased out to support the pandemic stressed taxpayers:

- Incentives for generating employment opportunities: Unemployment has been a very big issue which worsened during the pandemic and it is imperative that the Government comes up with certain incentives that generate new employment avenues and provide sustainable job growth. The ambit of deduction under section 80JJAA of the IT Act can be liberalised by increasing the existing salary limit and reducing the number of days requirement. The focus could be on the knowledge economies and industries that encourages intellectual ability of the people.

- Allowing higher depreciation: The pandemic stressed sectors may be provided a higher or additional depreciation under section 32 of the IT Act for certain years, in order to motivate capital investment.

- Specific incentives to certain targeted sectors: There has been no major announcement of launch of a major greenfield project by any big industrialist in the recent past. It appears that the industry is adopting a “wait and watch” policy and waiting for the Government to dole out schemes before making any big announcements. There is a case to provide special tax incentives to industrialists/ companies undertaking major investments in identified greenfield projects as that can stimulate the entire ecosystems.

- Increase in time period for carry forward of business losses: As the financial year 2020-21 will result in losses for most of the businesses, it may make sense for the time period available for carry forward and set off of business losses to be extended to 10 years as a one-off opportunity, so that the impact of COVID-19 does not come in the way of business cycles.

- Impetus on MSME: The MSME had been and will continue to be a great job creator. The Government must stimulate job creation in MSME through additional tax incentives for new projects, reduction in indirect taxes like lower stamp duty and GST on capital investments, greater incentives for additional job opportunities, etc., in order to give effect to the resurrection of MSME sector.

- Reduction in tax rates for LLPs and firms: While the tax rate for companies with turnover of INR 400 crores had been reduced to 25% last year, the firms and LLPs are still subject to tax at the rate of 30%. Thus, providing a level playing field to firms and LLPs by slashing the tax rates may be a wise decision.

- Speedy processing of refund and ease in recovery of dues: The Government has prioritised the processing and issuance of pending refunds during the pandemic. While it is a welcome step, it may also be a good idea for the tax authorities to go slow on their assessment and recovery initiatives for some time, so as to give a chance to the industry to get over this unprecedented crisis and move back to their more familiar growth trajectory.

(B) Amendment in certain tax provisions:

We have highlighted below some other provisions which could be rectified/rationalized in this budget.

- Restructuring the litigation process: At present, the process of resolution of tax litigation in India is a very lengthy, time consuming and costly affair. While it entails payment of interest and penalties by the taxpayer as per the various provisions, the chronically slow pace blocks even the legitimate dues of the Government for a long time.

The Government should come up with a permanent litigation mitigation scheme or a self-disclosure scheme wherein taxpayers shall be allowed to have a mechanism wherein all pending or forthcoming tax disputes can be resolved in a timely and cost-effective manner.

- Rationalising penalty provisions: The rates of penalty presently provided under the IT Act are very high being either 50% or 200% of the taxes payable. While the penalty provisions should surely exist in the statute and serve as a deterrent for taxpayers intentionally avoiding tax, the quantum should ideally be reduced and brought at par with international standards.

- Tax in hands of shareholders for dividend should not be higher than the Dividend Distribution Tax (“DDT”) that it has replaced: Till recently, the form of entity (individual, company or any other form) did not impact the rate of taxation of dividends. However, the recent shift in the taxability of dividend in the hands of shareholders has caused an inequality wherein the individuals and private trusts are taxed at higher rate of tax which could be as high as 42.74% as opposed to 22% / 30% in case of companies and partnerships/ LLPs.

As the intention of this amendment was to make investment in equity more attractive, the rate of tax on all shareholders in respect of dividends should be capped at 20% plus surcharge and cess. No additional revenue would be lost in this scenario.

- Dividends in the hands of unit holders of Business Trusts should be exempt: The abolition of DDT by the Finance Act 2020 has made investments by InvITs and REITs less attractive, since the investors would have to bear the incidence of tax on dividends as opposed under the DDT regime where there was nil DDT on SPVs when they distributed dividends. Presently, dividends received by the unit holders is not exempt if the distributing company has opted for tax at the rate of 22%. This provision should be amended to ensure that dividends received by the unit holders are exempt from tax.

- No Minimum Alternate Tax (“MAT”) on dividend income of a foreign company: When the Indian company was required to pay DDT, dividends were exempt in the hands of shareholders during the DDT regime and foreign companies were also not liable to pay MAT on dividend income. However, as per the existing provisions of section 115JB, dividend income of foreign companies may be considered for MAT even if its taxable rate under the IT Act/ DTAA is less than the MAT rate. Therefore, section 115JB should be amended to carve out the dividend income of foreign companies from the MAT regime if tax rate of such dividend is less than the MAT rate.

- Tax on buy back of shares of listed companies should be reduced to 10%: The difference between the consideration paid by the company on buy-back and what it received on the subscription of the said shares is taxed as distributed income under section 115QA at the rate of 20% (plus applicable surcharge and cess).

This taxability is neither aligned with the practice of taxation of buy-back across the world, nor is fair in respect of a shareholder, who faces tax incidence on buy-back at 20% (plus surcharge and cess) though levied on the company, compared to sale of listed shares resulting in long term capital gains being taxed at the rate of 10% (plus applicable surcharge and cess) under section 112A of the IT Act. Therefore, the buy-back tax in case of shares should be reduced to 10%. Further, the tax credit should be given to the shareholder, especially those who had acquired the shares in the secondary market, if the gains realized by him is less than the gains computed by the company for the purpose of buy-back tax.

- Exemption to rights issue/bonus issue from applicability of section 56(2)(x): Section 56(2)(x) imposes taxes on the recipient who receives a property for a value less than its fair market value. The tax authorities are increasingly invoking this section to impose taxes on bonafide rights/bonus issues. This provision was introduced as an anti-abuse provision and therefore, if the taxpayer is able to establish that there is no deliberate attempt to evade or avoid taxes and there is no malafide intention in the transaction, then section 56(2)(x) should not be made applicable. More particularly, this provision should not be attracted in cases of rights/bonus issues where there are no disproportionate allotments.

- Shareholder level exemption in case of offshore amalgamation or demerger: The IT Act grants exemption from taxes in cases of transfer of shares of an Indian company by an amalgamating foreign company to an amalgamated foreign company subject to the satisfaction of certain conditions. Similarly, it also provides for exemption in cases of transfer of shares of an Indian company by demerged foreign company to resulting foreign company, subject to the satisfaction of certain conditions. However, no exemption is provided to transfer of the shares held by the shareholders in the demerged/ amalgamating foreign company.

As India is making rapid strides towards full capital convertibility and the extent of foreign direct investment is increasing at a significant rate, it is imperative that the tax legislation is also revised to absorb and promote the new reality. In order to ensure that the intention is appropriately reflected in law and offshore amalgamations, offshore mergers and demergers do not result in taxability of non-resident shareholders in cases of such business reorganisations and also to ensure that Indian tax laws are in sync with global tax rules and regulations, it is imperative that exemption is granted to non-resident shareholders of offshore amalgamating / demerged companies from any capital gains tax in India.

- Time limit for withholding tax defaults in cases of payments made to non-residents: The IT Act provides no time limit in respect of passing an order against a person who defaults in deducting or depositing tax with respect to payments made to non-residents. It may be noted that 7 year limitation period is provided for payments made to residents on which taxes were required to be withheld. Various Courts have held that the penal action should be taken by the department within a reasonable time. However, there is no clarity on what constitutes the reasonable time, and it could be alleged that the Courts can only interpret the law as drafted and should not be providing something that is missing. This leads to uncertainty and causes significant delays and unnecessary indemnities being sought in M&A transactions, which are essential for the economy. This lack of clarity needs to be addressed and in order to remove any such past anomalies, it is suggested that the time period of 7 years should also be provided in the case of payments made to non-residents as well.

Conclusion

This is an extremely crucial time period for the Government to come up with an imaginative budget that takes into account the varied degrees of expectations that has been built up over the last few weeks. The FM has also added to the hype by suggesting that this would be a unique and a “never attempted before” budget. While it remains to be seen how the budget turns out to be and to what extent, it is able to satisfy the much awaited and varied degrees of expectations across sections of the society, this is a golden opportunity for the Government to leave the horrors of the previous year behind and embark upon a new journey.

Budget 2021 - A Tool to Retain Interest of Foreign Investors

This article has been co-authored by Bhargav Selarka (Director), EY India.

The Finance Minister’s statement that this budget shall be “unlike anything in the past 100 years” has significantly enhanced taxpayers’ curiosity and amidst renewed hope of the pandemic situation improving, expectations from Budget 2021 have also increased.

While the lockdown in Q1 of FY21 and prolonged restrictions have pushed India into a technical recession which is evident from its GDP numbers, the Indian stock markets have shown promising signs with the benchmark BSE Sensex achieving an all-time high of 50,000 on the 21st day of the 21st year of the 21st century. Also, the Q2 earnings and Q3 earnings of several Indian companies have so far shown signs that an economic recovery may soon happen.

Given the optimism, the stock markets have been trading at the highest volumes and Foreign Portfolio Investors (FPIs) have been pumping in money at record highs clearly placing their faith in India as an emerging economy.

FPIs are expecting Budget 2021 to provide a stimulus to the already bullish market. A few expectations of the FPIs from a income-tax standpoint are given below:

Withholding tax on dividend pay-outs to FPIs

The removal of Dividend Distribution Tax (DDT) by the Budget 2020 has resulted in Foreign Portfolio Investors (FPIs) having to pay tax at the rate of 20% (plus applicable surcharge and cess) [subject to relief under any applicable tax treaty entered into by India].

Dividend paying Indian companies are required to deduct tax while making dividend payments to the FPIs. On account of several reasons these companies have been deducting tax at the rate of 20% (plus applicable surcharge and cess) from dividends paid to the FPIs whereas the final tax liability of most FPIs is at tax treaty rates which are lower. This has a potential cash flow impact in the hands of the FPIs as the excess taxes deducted (in cases where the tax treaty rate is more beneficial) would need to be claimed by the FPI only at the time of filing the return of income if they have no other taxes payable on any other income/ gains.

While in certain cases the excess tax may be utilised by the FPI towards its other income-tax liability for the same financial year, the excess tax withholding does result in an increase in compliances for the FPIs. Though this is a relatively minor ask the amendment to this effect enabling tax withholding at the treaty rates will boost investor sentiment.

Reduction in long-term capital gains tax rate

With a view to increase the inflow of long-term stable foreign monies into India, it is imperative to provide attractive tax rates in comparison with the globally competitive jurisdictions. Majority of the countries in Asia-Pacific and Europe do not levy any capital gains tax on listed portfolio investments. None of the G20 countries levy capital gains tax on portfolio investments by foreign investors. India is the only country in BRIC to do so.

While until a while ago India too did not levy long-term capital gains tax on gains from transfer of listed equities, there was a policy shift in 2018 through introducing a long-term capital gains tax. While the real expectation of the foreign investors (including domestic for that matter) is for the removal of long-term capital gains tax, at best, the Government may consider reducing the long-term capital gains tax rate from 10 percent to percent and/ or the exemption limit may be enhanced to INR 5 lakhs (as against the existing limit of INR 1 lakhs).

The above changes will surely encourage the FPIs to adopt a long-term strategy so as to ensure more stability and support during the revival phase.

Removal of disparity in holding period for debt securities

Debt funding plays an equally important role as equity in providing finance to various sectors of the economy. Financial institutions as well as Indian companies issue a myriad of debt instruments for raising monies from various global and Indian investors.

From an investment standpoint, conservative/ risk averse investors prefer to make a debt investment (as against equity). Further, the debt instrument also provides for a stable source of income on a periodic basis in the form of interest.

Currently, the holding period threshold of certain debt securities like debt-oriented mutual funds, unlisted debentures/ bonds, etc is 36 months for the assets to qualify as a long-term capital asset (as against the threshold of 12 months for equities/ units of equity oriented mutual funds, etc).

Recognizing the importance of debt funding in nation building and in an attempt at providing a level playing field to the investors, the period of holding in case of debt securities should also be reduced to 12 months (owing to the beneficial rate of tax for long-term capital gains of 10%).

From an FPI standpoint, a lot of FPIs adopt a pure ‘debt’ strategy and the above proposal is likely to further incentivise and boost investment in debt instruments.

Conclusion

The Government has always paid careful attention to foreign investors’ sentiments, particularly that of FPIs which are large investors in the Indian capital market. A lot has been done over the years to simplify the tax regime for FPIs. A stable and simple set of provisions has gone and will go a long way in keeping FPIs engaged with India as an investment destination.

Union Budget 2021 - Amendments for Timely Recovery of India Inc.

This article has been co-authored by Rahul Sateeja (Counsel), DMD Advocates.

Within a week from today, the Finance Minister will be presenting the Annual Budget in the shadow of the pandemic. The Rs. 20 trillion stimuli injected into India Inc. has not healed the wounds inflicted by the most stringent lockdown which resulted in a grinding halt of the economic engines. While last few months have shown a ray of hope as economic activities have surged, the right announcements in the Budget will be crucial as it will lay down the path for a timely recovery of India Inc.

Some of the technical changes on the Direct Tax front that assessees are looking forward to are:

- Opportunity of personal hearing to be provided as a matter of right in the faceless assessment scheme

On the Direct Tax front, there have been significant changes at a policy level. A Direct Tax Charter has been introduced with the right intentions by the Government and the entire process of assessment of income and the first appeal before the Tax Department has been shifted to a faceless scheme. The changes of this policy will be known after it has been experienced by assessees. A basic foundational defect is the denial of an opportunity of personal hearing to the assessee as a matter of right. This right has been circumscribed and is subject to the approval of the Chief Commissioner or the Director General. Considering this restriction, a petition has been filed before the Delhi High Court (Lakshya Budhiraja vs Union of India-WP No. 8044/2020) challenging the scheme to be arbitrary, discretionary and in violation of Article 14 of the Constitution of India.

It is a settled proposition of law that principles of audi alteram partem must be extended in administrative proceedings where the decision of the authority results in civil consequences [See Dharampal Satyapal vs Deputy Commissioner of Central Excise- (2015) 8 SCC 519]. Accordingly, a suitable amendment must be made in the scheme to allow every assessee, as a matter of right, to be personally heard as usually an income tax assessment entails complex issues and calculations that may not be sufficiently explained based on written submissions alone and oral clarifications are required.

- Income arising from a transaction subject to the expanded equalization levy has to be exempted under Section 10(50) from 1st April 2020 onwards

The contemporanea expositio through the Report of the Committee on Taxation of E-Commence, 2016 is that the expanded Equalisation Levy is not a “tax on income” and therefore, the income derived from the transaction on which the expanded scope of EL applies must be exempt. Since the expanded levy is applicable w.e.f 01.04.2020, the income on a transaction of digital sales/services or facilitation thereof which is subject to the expanded EL must also be exempted from April 2020 onwards. The extant provision of Section 10(50) applies from April 2021 onwards (a year later) which must be clarified to apply from April 2020 i.e. the date of introduction of the levy.

- Increase the efficacy of the Authority for Advance Tax Rulings

The Hon’ble Supreme Court in the case of National Co-operative Development Corporation v CIT- Civil appeal nos. 5105 to 5107 of 2009 dated September 11, 2020 recommended that a vibrant system of Advance Rulings can go a long way in reducing tax litigation. The Hon’ble Court observed that the forum established to provide certainty and avoid litigation involving non-residents has now been plagued with problems like (i) large number of applications pending due to the low disposal rate; (ii) lack of adequate numbers of presiding officers to deal with the volume of cases; (iii) vacancies and delayed appointments of members; (iv) average time taken is 4 years in deciding an application. Due to these ground realities, the very purpose of AAR for which it was created in 1993, is defeated. The Hon’ble Court also took note the international scenario (AAR mechanisms in Australia, New Zealand, United States, Sweden) and observed that the advance ruling system ought to be a dialogue between taxpayers and the revenue authorities for bolstering tax compliance and morale and should not become another stage in the litigation process. The Apex Court thought it appropriate to recommend to the Central Government to consider the efficacy of the advance tax ruling system and make it more comprehensive as a tool for settlement of disputes rather than another tier for litigation. The Court also suggested that a council for Advance Tax Ruling based on the Swedish model and the New Zealand system may be a possible way forward.

The Government must take note of observations and suggestion of the Apex Court and consider making changes in the AAR scheme so that the rulings are issued timely and the appointment and vacancies are not delayed. The average time of disposal of an application takes minimum of 2-3 years which has failed the objective of tax certainty in a timely manner with which it was introduced by the Parliament. The limit for approaching the AAR for residents should be reconsidered and reduced from the present limit of transactions of 100 crores or more.

- Limitation to be introduced for passing an order in case of non-residents

Section 201 envisages that if a person responsible for deduction of tax at source fails to deduct the whole or any part of the tax or after deduction fails to deposit the same to the credit of the Central Government, then he shall be deemed to be an assessee-in-default.

Section 201(3) provides for a limitation period for passing an order in cases where payments are made to a person resident in India. However, no limitation period or time-limit has been prescribed for passing an order against a person who makes payments to a non-resident. This has led to prolific ligation before various High Court [Delhi – CIT v. NHK Japan Broadcasting Corpn. [2018] [TS-83-HC-2008(DELHI)-O] (Delhi)- Calcutta Bhura Exports Ltd- TS-517-HC-2011(CAL)- contrary decision]. To bring a quietus to the unwanted litigation the Government may consider making a necessary amendment and specifying a time limit for passing an order in cases where payments are made to non-residents.

- Parity required in certain provisions under the Income Tax Act

- No prosecution should be launched under Section 276BB if there is a reasonable cause of default.

Section 276B provides for prosecution in cases where the assessee has failed to deposit the tax deducted by him and Section 276BB provides for prosecution in cases where an assessee has failed to deposit the tax collected by him.

Section 278AA provides relief from the prosecution if the assessee proves that there was a reasonable excuse for failure. The said provision is made application to Section 276B and does not include Section 276BB. Since both the provisions deal with similar situations of default in deposit of tax deducted or collected, there must be parity in both and a suitable change should be introduced.

- Corporate tax rate parity between foreign and domestic companies

The domestic companies in India have effective corporate tax rate of 25.17% [without exemptions and concessions] and those engaged in manufacturing and incorporated after 1 October 2019 pay corporate tax at rate of 17.1% [without exemption/concessions]. However, the effective corporate tax rate for a foreign company is 43.68%. Therefore, Finance Minister may consider having a tax rate parity between domestic and foreign to provide a level playing field or consider reducing the disparity in rates.

Budget 2021 - Stage Set for Overhaul in Business Trust Tax Framework?

This article has been co-authored by Rajesh Mittal (Director) and Yezdi Irani (Manager), EY India.

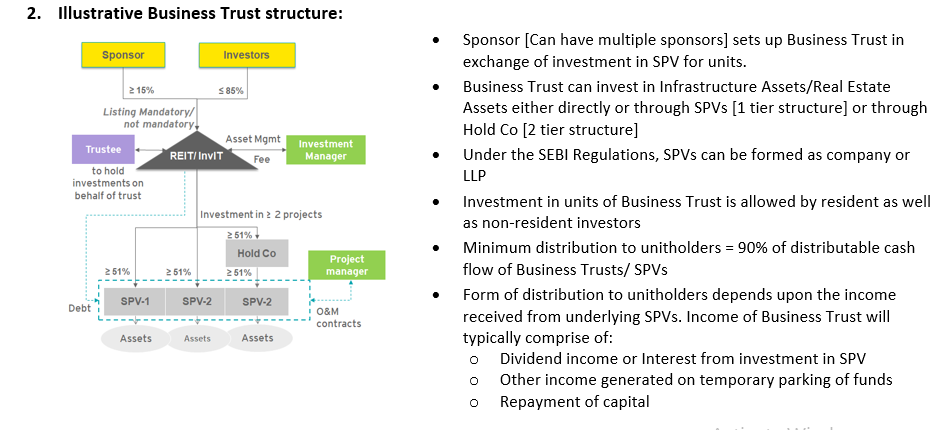

1. Background of Business Trust

Infrastructure Investment Trusts (“InvIT”) and Real Estate Investment Trusts (“REIT”) [collectively referred to as ‘Business Trusts’] have been one of the fund raising model introduced in the Indian capital market since its introduction by Security Exchange Board of India (“SEBI”), especially for the capital intensive Infrastructure and Real estate sectors.

With few players listing their portfolio of assets, these models have seen over Rs. 77,700 crores of capital (domestic + foreign) being raised in shorter period of time. Further, the existing listed Business trust has significant potential to raise further funds from Foreign capital market. They enhance the depth of India’s capital markets and also assist the Government achieve its target of making India a $5 trillion economy and increase Indian Forex reserve.

Some of the largest Global institutional investors / SWFs / pension funds are backing these fund raising either as sponsors or significant investors. Listing of Business Trusts provides access to funds for further acquisitions, unlocking value and increase Indian Forex reserve etc. In the following table, we have captured certain Business Trust that are listed/ unlisted in India or in the process of being set-up:

|

Name |

Parties |

Type |

Assets |

Equity Raise (Rs. Cr) |

|

Indi Grid Trust |

KKR |

Public InvIT |

Power Transmission |

2,514 |

|

IRB InvIT Trust |

IRB Infrastructure |

Public InvIT |

Road Assets |

5,032 |

|

Reliance Infrastructure InvIT Fund |

Reliance |

Public InvIT |

Road Assets |

2,500 |

|

India Infrastructure Trust |

Reliance – Brookfield |

Private InvIT |

Gas Pipeline |

6,640 |

|

Indinfravit Trust |

L&T IDPL |

Private InvIT |

Road Assets |

3,145 |

|

Oriental Infra Trust |

Oriental |

Private InvIT |

Road Assets |

2,306 |

|

Tower Infrastructure Trust |

Reliance – Brookfield |

Private InvIT |

Tower Assets |

25,000 |

|

IRB Infrastructure Trust (unlisted) |

IRB-GIC |

Private InvIT |

Road Assets |

6,640 |

|

Digital Fibre InvIT |

Reliance |

Private InvIT |

Fibre Optic Assets |

14,710 |

|

Embassy Office Parks REIT |

Blackstone |

Public REIT |

Real Estate Assets |

4,750 |

|

Mindspace Business Parks REIT |

K Raheja - Blackstone |

Public REIT |

Real Estate Assets |

4,500 |

The draft guidelines were issued in 2008 to facilitate set-up and listing of the Business Trust. However, Business Trust were not able to take off until 2017, which were facilitated by various regulatory changes introduced in various Regulations. In order to promote investor participation, the Ministry of Finance (‘MoF’) enacted a beneficial taxation regime for Business Trusts through a series of amendments in the Indian Income Tax Act (“the Act”) from Finance Act, 2014 onwards. Following this, the Late Hon. Finance Minister Arun Jaitley’s 2016 Finance Bill introduced a single level of taxation for Business Trusts. These changes that were introduced in tax regimes over the period of time were consistent to certain extent to the global frameworks of taxation of Business Trust.

The Finance Act, 2020 abolished Dividend tax regime (“DDT”) and introduced classical system to tax dividend. Such change triggered to amend Tax law for dividend distributed by the Business trust to bring in parity with single level taxation, whereby in case if the underlying SPV [defined in section 10(23FC) of the Act] has opted for concessional tax regime under Section 115BAA of the Act, the dividend income distributed by Business Trust is taxable at unitholder level at applicable rates in the hands of the unitholders. If the SPV continues under the old regime [i.e. SPV’s has not opted for Tax regime under section 115BAA of the Act], the dividend income would be exempt in the hands of the unitholders.

Additionally, Finance Act, 2020, inter-alia, provided that tax on income arising in the hands of ‘Specified Persons[1]’ in the nature of dividend, interest and long-term capital gains arising from investments in Business Trusts in India has been exempted, subject to satisfaction of prescribed conditions.

Also, the existing provisions of the Act which provided for a beneficial tax regime for listed Business Trust, were further extend to unlisted privately placed Business Trust, which is in line with the SEBI Regulations which provides for unlisted InvITs to get the same status as of listed InvITs.

3. Upcoming Union Budget – Opportunity to attract Investor participation and put the Indian Business Trust market competitive on a global scale

To restore the confidence of the developers and investors back in Business Trust structure, some amendments need to be introduced by the Finance Minister for setting the context for future years. The forthcoming Union Budget 2021 provides a perfect platform to the Finance Minister [‘FM’], as our FM walks the tightrope, she faces the onerous task of striking a balance between swings in the economy that have been created due to COVID 19, India's towering aspirations to become a global leader economy and fiscal prudence.

With this background, following changes could be consider to be introduced by FM in this Budget in the Tax and Regulatory regime:

- Specific exemption for no lapse of losses on migration of SPVs into Business Trusts

Currently, on transfer of shares of SPV by the Sponsor to the Business Trust (of more than 49%) in lieu of units of the Business Trust, brought forward losses of the SPVs get lapsed pursuant to limitation getting triggered under section 79 of the Act. Further, for an Indian company to qualify as an SPV under the SEBI regulations, the Business Trust is required to hold at least 51% of the equity stake in such company. Thus, Sponsor has to transfer at least 51% stake in the SPV to the Business Trust and the losses of the SPV will always get lapsed on account of such transfer.

Specific exemption under section 79 could be introduced to provide that losses shall not lapse on migration of SPVs into Business Trusts.

- Holding period for (i) listed units of Business Trust to qualify as long-term capital asset should be reduced to 12 months from 36 months and (ii) for unlisted units of Business Trust to be reduced to 24 months

One of long outstanding demand of the Industry players is to put the level playing field between Listed equity shares and units of Business Trust. Currently, in case of securities (other than a unit) listed on a recognized stock exchange in India or a unit of the Unit Trust of India or a unit of an equity oriented fund or a zero coupon bond, the holding period for being classified as a long-term capital asset is a period of more than 12 months.

Similarly, in case of share of a company (unlisted), or an immovable property the holding period for being classified as a long-term capital asset is more than 24 months. However, the period of holding for units of listed Business Trust to qualify as long-term capital asset is still more than 36 months.

Reduction of holding period to 12 months for listed units and 24 months for unlisted units will bring parity between equity shares and units and boost investor participation in Business Trusts.

- No withholding of tax by SPVs on distribution of dividend income or interest on securities to Business Trusts

As per the extant provisions, while dividend income and interest on securities paid by SPVs to Business Trusts has been exempted from tax in the hands of Business Trusts under section 10(23FC) of the Act, the SPV paying such dividend or interest on securities is required to withhold tax on such dividend or interest on securities at the applicable tax rates provided under section 194 and section 193 of the Act respectively.

Section 194A of the Act which is applicable to payment of interest other than on securities provides a specific exemption on interest paid by SPV to Business trust. However, similar exemption is not provided in section 194 (for dividend income) and interest on securities (section 193) paid by SPVs to Business Trusts.

Thus, there is an inconsistency between the chargeability of dividend income and interest on securities and withholding of tax with respect to such income in the hands of Business Trusts.